R&D Tax Preparation

Swanson Reed Specialist R&D Tax Advisors have over 30 years of consulting experience. Claiming the R&D tax credit doesn’t have to be an expensive and difficult process. The R&D tax consultants at Swanson Reed manage all facets of the R&D tax credit program with professional ease.

WE’LL DO ALL THE HARD WORK FOR YOU

Self-claiming the R&D tax credit can be time consuming and risky. A standard claim can usually be professionally complied with only 2-3 hours of staff time. Our experts will maximize the benefit you receive.

OUR OFFER IS RISK FREE

If you don’t receive a benefit, you don’t pay. You will never be out of pocket.

NO WIN = NO FEE

SPECIAL PROMO!

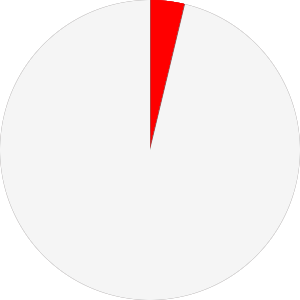

Pay only 10% of your benefit*

Quote the promo code SR10 to claim this offer!

*Minimum fee per single project claim. Multi project claims subject to negotiation.