Learn How to Prepare R&D Tax Claims

Swanson Reed’s in-depth research into R&D claims and case law was published in The Tax Advisor.

<image here of book>

Free R&D Tax Credits Reference Guide

WHAT IS THE FEDERAL R&D TAX CREDIT?

R&D = Research and Development (also known as the Research and Experimentation Tax Credit). The tax credits are an incentive for businesses to innovate and improve, through experimentation in the United States.

For the first three years of R&D claims, 6% of the total qualified research expenses (QRE) form the gross credit. In the 4th year of claims and beyond, a base amount is calculated, and an adjusted expense line is multiplied times 14%.

All industries and most types of businesses can qualify for the R&D tax credit if they can satisfy the 4-Part Test.

IRS’ 4-PART TEST

- Is the work technological in nature?

- Is there a permitted purpose?

- Is there elimination of uncertainty?

- Is there a process of experimentation?

R&D Tax Credits Explained

Learn more

Our nationwide workshops and seminars that help you learn about:

- What the R&D tax credit prodram entails;

- Identification of eligibile activities, using industry specific case studies;

- What expenditure can be claimed;

- What documentation is required to support each claim; and

- How we will work with you to proactively identify and track R&D projects going forward.

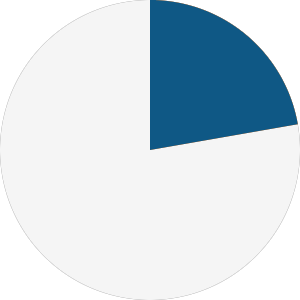

How much can I receive?

Your spend

Your claim

Our fee

Your credit

Calculate your R&D Credit Benefit

How does it work?

We’ve helped more than 1500 companies claim their R&D Qualified Research Expenses. So, chances are, we can help in your business.

Want to get industry specific examples? Take a look. Our Case Studies exemplify the application of key legislative requirements in different sectors. They are real-life examples of what you can claim and how.

Want to know more about the legislation? Take a look. Our Case Law examples are real-life cases that have taken place, with relation to R&D. You can find examples of what to do, what not to do, and what to be aware of.