Increased 3D Printing in STEM Initiatives Assisted by R&D Tax Credit

Science, technology, engineering, and mathematics (STEM) initiatives have recently turned to 3D printing to build tools and equipment in response to the increasing demand for laboratory equipment. Tools are built faster and more cost-effective when created using 3D printers. The Research and Development (R&D) Tax Credit aids in this type of work by encouraging innovation.

The R&D Tax Credit, introduced in 1981, allows up to 13% credit for eligible spending on project and product innovations. Research qualifies by meeting the Four-Part-Test:

- New or improved products, processes, or software

- Technological in nature

- Elimination of uncertainty

- Process of experimentation

The R&D Tax Credit was made permanent by President Obama on December 18, 2015. Costs such as labor, supplies, testing, research expenses, and developing a patent are all eligible under the R&D Tax Credit. Startup businesses have an allowance of $250,000 per pay year in payroll taxes that they can use the credit against.

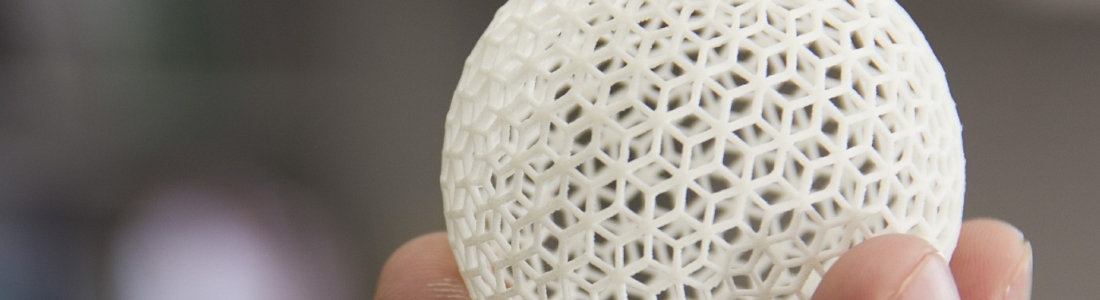

The vast array of products created through 3D printing have a direct benefit to STEM initiatives. These benefits range from materials including plastics, steel, copper, and ceramics, to equipment such as beakers, test tubes, pulleys, microscopes, and custom add-on components for equipment and instruments. As well developing an extensive range of products, there are also cost-saving benefits to 3D Printing. A recent study by the Public Library of Science found over 97% cost reductions using 3D printed optics equipment.

Scientists and engineers are also turning to open source models in which designs are shared for 3D printed lab equipment. The model originates from computer science where programmers made source code publicly available for use or modification from the original design. In 3D printing, exact replicas or modified designs are being created using this open source concept which promotes evolution and improvements along the way.

Scientists and engineers using 3D printing in innovation may be eligible for R&D Tax Credits. To find out if your project qualifies or to learn more about the program, contact a Swanson Reed Tax Advisor.