R&D Tax Credit Opportunities within the 3D Printing Industry

3D printing is expected to grow more than 31% every year, surpassing $1.4 billion in revenue in the U.S. alone. Startup businesses have the opportunity to apply for research and development (R&D) tax credits if they are producing new or improved products or services, including the materials and software associated with 3D printing.

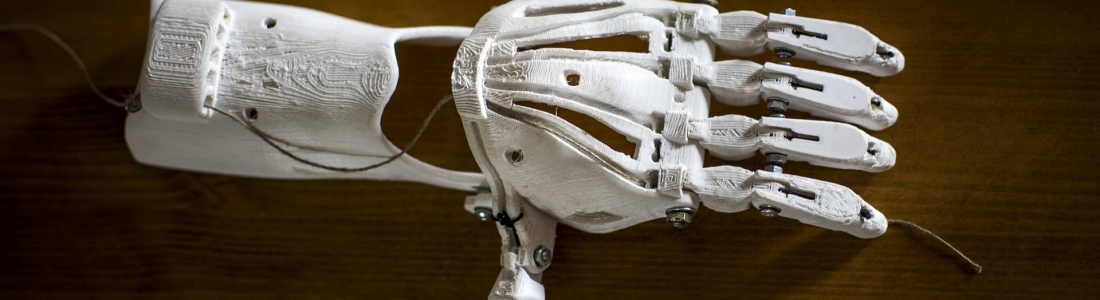

The most difficult task for a startup is deciding which business model to use, including their manufacturing model. Startups are tending to favour 3D printed products, as they are more responsive than traditional manufacturing methods – being readily customizable, with a fast turnaround time and low production costs. The large investment in 3D printing has resulted in huge progress over the recent years. However, it is widely recognized that there is still considerable progress to be made. The significant research and experimentation being undertaken in this industry means it is a prime candidate for R&D tax funding.

All businesses have the opportunity to apply for the R&D Tax Credit, which is backed by both the Federal and State governments. Now is the time for 3D printing businesses to take advantage of the possible 14% R&D Tax Credit. If your company is experimenting with new technology or products, contact a Swanson Reed R&D Tax Advisor today to see if you are eligible to claim.