R&D Amortization and the R&D Tax Credit

Key Takeaway: Companies who perform and incur research and experimental expenses must amortize their R&E costs, regardless of whether or not the R&D Tax Credit is claimed.

While the Tax Cuts and Jobs Act (TCJA) became effective January 1, 2018, not all provisions came into effect right away. One such provision included changes to the treatment of research and experimental (R&E) expenditures. This provision, outlined in Section 13206 of the TCJA, became effective for tax years beginning after December 31, 2021, and will have a ripple effect in both financial and tax reporting.

The Change

Section 13206 amended Sec. 174, requiring taxpayers to amortize specified R&E expenditures ratably over a 5-year period for domestic expenditures and a 15-year period for specified R&E expenditures attributed to foreign research, using a half-year convention.

In this amendment, the TCJA also changed the term “research or experimental expenditures” under the old Sec. 174(a) to “specified research or experimental expenditures.” The amendment defines specified research or experimental expenditures as “research or experimental expenditures which are paid or incurred by the taxpayer during such taxable year in connection with the taxpayer’s trade or business.”

Software development costs were also specifically mentioned. Software development expenses incurred in tax years starting after December 31, 2021, are no longer deductible under Rev. Proc. 2000-50. Instead, they must be treated as R&E expenditures under Sec. 174 and, as such, amortized.

History

In the past (i.e. for tax years beginning before December 31, 2021), taxpayers were able to treat R&E expenditures in one of four ways:

- Currently deduct costs under Sec. 174(a);

- Capitalize the costs (if not subject to depreciation or depletion allowances under Sec. 167 or 611) and then amortize them over a period of not less than 60 months under Sec. 174(b), beginning with the month in which they first realize benefits from the expenditures;

- If neither (1) nor (2), they could charge them to capital account under Regs. Sec. 1.174-1; or

- Under Sec. 59(e), they could capitalize and amortize ratably certain qualified expenditures over a 10-year period. Under Sec. 59(e)(2), a qualified expenditure is any amount that would have been allowable as a deduction for the tax year in which the expenditure was paid or incurred. Under Sec. 59(e)(2)(B), expenditures under Sec. 174(a) would have qualified for the 10-year amortization treatment.

What This Means for the R&D Tax Credit

First, the TCJA did alter the definition of qualified research under Sec. 41 (d)(1), moving from “expensed under section 174” to “specified research or experimental expenditures under Section 174). This change aligns the definitions of qualified research in Secs. 41 and 174. In other words, specified R&E expenditures for the credit under Sec. 41 must first be included in specified R&E expenditures under Sec. 174. Prior to the TCJA, the Sec. 41 credit only required that R&E expenditures were eligible for Sec. 174 treatment.

It is important to note that the changes made to Sec 174 are not contingent on claiming the R&D tax credit. In fact, it’s the reverse. Any and all R&E (i.e. Sec 174) costs must be subjected to the new provision regardless of whether or not your company claims the R&D tax credit. The credit can only be calculated using those R&D (i.e. Sec 41) expenditures which have been included in Sec 174 treatment.

Second, the TCJA made a conforming amendment to Sec. 280C(c) to preclude taxpayers from receiving a double benefit. Sec. 280C(c)(1) provides that if the amount of the credit under Sec. 41(a)(1) exceeds the amount allowable as a deduction for a tax year for qualified research expenses or basic research expenses, then the amount chargeable to capital account for the tax year for such expenses is reduced by the amount of the excess. In other words, if the amount of the Sec. 41 credit exceeds the amount of deductible qualified R&E expenditures, then the amount of the capitalized R&E expenditures must be reduced by this excess.

280C(c) Example

A taxpayer has a $150,000 research credit and an allowable $100,000 qualified research expense deduction (i.e. the current year deductible portion of the R&D expenses). The taxpayer must reduce the capitalized portion of the R&E expenditures by $50,000. The taxpayer may avoid this result by instead electing to reduce the credit under Sec. 280C(c)(2) on a timely filed tax return. The first few years of this change will present some challenges. However, as time passes, the impact of this rule change should diminish.

What This Means Long Term

Assuming Congress does not delay, postpone, or repeal the amortization of R&E expenditures this year, federal tax liabilities of taxpayers with these expenditures may increase. The current R&E expenditure deduction will be cut by 90% in the first year under a five-year amortization period (15-year for foreign R&E expenditures) and a half-year convention.

Taxpayers with stable R&E expenses will see a return to normal within a few years, wearing the currently deductible R&E expenditures will approach the levels that were deductible before the change.

Value of the R&D Tax Credit with a Stable R&E Spend Example

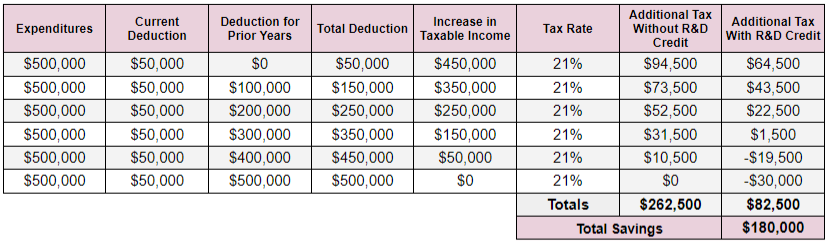

In this example, a taxpayer incurs $500,000 per year in R&E expenditures (Sec 174). Out of this, $400,000 are determined to be R&D expenditures (Sec 41), resulting in a net R&D tax credit of $30,000 annually. Assuming these values are stable each year, the table below demonstrates how the amortization of the Section 174 Expenses will impact the amount of tax owed.

After the sixth year, the amount of deductible R&E expenditures will be at the levels prior to the rule change. In addition, the R&D tax credit helps to alleviate the tax burden sooner than without the credit. Generally, taxpayers will pay more in taxes in year 1 and 2, but not more overall.

Are you developing new technology for an existing application? Did you know your development work could be eligible for the R&D Tax Credit and you can receive up to 14% back on your expenses? Even if your development isn’t successful your work may still qualify for R&D credits (i.e. you don’t need to have a patent to qualify). To find out more, please contact a Swanson Reed R&D Specialist today or check out our free online eligibility test.

Who We Are:

Swanson Reed is one of the U.S.’ largest Specialist R&D tax advisory firms. We manage all facets of the R&D tax credit program, from claim preparation and audit compliance to claim disputes.

Swanson Reed regularly hosts free webinars and provides free IRS CE and CPE credits for CPAs. For more information please visit us at www.swansonreed.com/webinars or contact your usual Swanson Reed representative.