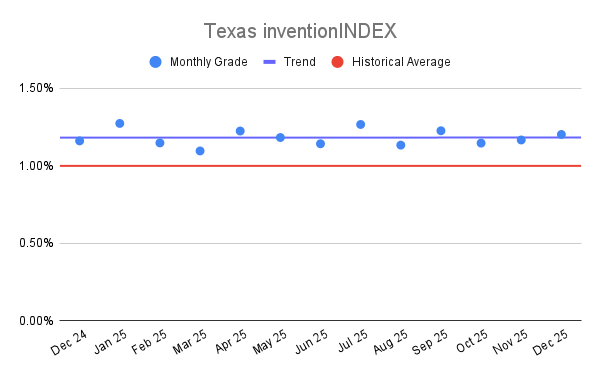

FEDERAL INVENTIONINDEX | DECEMBER 2025

December 2025: 1.54% (B+ grade) Federal inventionINDEX December 2025: 1.54% (B+ grade) The inventionINDEX measures innovation output by comparing GDP growth with patent production growth. [...]

Texas R&D Tax Credit Filing Instructions

To claim the Research and Development (R&D) tax credit in Texas, businesses generally have two options: a sales and use tax exemption on depreciable tangible personal property used in qualified research, or a franchise tax credit based on qualified research expenses. To claim the franchise tax credit, which is often the primary R&D tax benefit for many businesses, a taxable entity must file their Long Form Franchise Tax Report (Forms 05-158-A and 05-158-B). Alongside this, they must include two crucial schedules: the Credits Summary Schedule (Form 05-160) and the Research and Development Activities Credits Schedule (Form 05-178). Businesses must also ensure they meet the specific eligibility criteria for qualified research expenses and activities as defined by the Texas Tax Code, which often align with federal IRC Section 41 guidelines, and maintain thorough documentation of all R&D expenditures. The credit can be carried forward for up to 20 years and is generally 5% of the amount by which current year qualified research expenses exceed a base amount (50% of the average QREs from the three preceding tax years). If contracting with higher education institutions, a higher credit rate may apply.

Texas Patent of the Year – 2024/2025

Ice Thermal Harvesting LLC has been awarded the 2024/2025 Patent of the Year for their innovative approach to energy generation. Their invention, detailed in U.S. Patent No. 12110878, titled ‘Systems and methods for generation of electrical power at a drilling rig’, introduces a novel method to harness waste heat from drilling operations to produce electricity.

ICE Thermal Harvesting’s patented system captures excess heat from drilling fluid, engine exhaust, and cooling systems. This heat is transferred to a working fluid via heat exchangers, which then drives an Organic Rankine Cycle (ORC) unit to generate electrical power. This process allows drilling operations to convert waste heat into usable electricity, reducing reliance on external power sources and enhancing energy efficiency.

The real-world impact of this technology is significant. By utilizing waste heat, drilling rigs can operate more sustainably, lowering operational costs and minimizing environmental impact. This innovation aligns with the industry’s push towards greener energy solutions and offers a practical application of renewable energy principles in the oil and gas sector.

Ice Thermal Harvesting’s advancement represents a step forward in integrating sustainable practices into traditional energy extraction methods, showcasing how innovation can drive efficiency and environmental responsibility in the energy industry.

Study Case

IVO Tech (IVO) is a leading software company specializing in employment screening software. The company was founded to provide new and innovative technologies to employment screening firms to help them improve productivity, reduce overhead, and have technological competitive advantages over otherwise similar firms.

IVO incurred qualified research expenses relating to the development of numerous innovative features in 2011-2013. IVO had never claimed the R&D tax credit before and was unaware it was performing qualified activities. After meeting with a specialist and learning more about R&D, IVO realized it was eligible for the credit.

The R&D tax credit specialist helped IVO determine its qualifying R&D activities, many of which were part of the company’s daily operations. IVO’s qualified research expenses (QRE) included:

- Development of new or improved software features to meet changing consumer preferences;

- Improvement to processing speeds

- Improvements for storage

- Testing across all supported releases to determine exposure

- Experimentation with possible fixes until an adequate solution was determined

- Creating and executing test cases to eliminate uncertainty prior to releasing software to customers

After adding up labor and supplies costs from 2011-2013, IVO spent $1.95 million on R&D for those three years. IVO claimed the Federal R&D Tax Credit and received a $45,000 tax credit.

After realizing the benefits, a sustainable methodology was also established to help IVO identify, document and substantiate eligible R&D projects and costs on an ongoing basis.

Qualified research consists of research for the intent of developing new or improved business components. A business component is defined as any product, process, technique, invention, formula, or computer software that the taxpayer intends to hold for sale, lease, license, or actual use in the taxpayer’s trade or business.

The Four-Part Test

Activities that are eligible for the R&D Credit are described in the “Four-Part Test” which must be met for the activity to qualify as R&D.

- Permitted Purpose: The purpose of the activity or project must be to create new (or improve existing) functionality, performance, reliability, or quality of a business component.

- Elimination of Uncertainty: The taxpayer must intend to discover information that would eliminate uncertainty concerning the development or improvement of the business component. Uncertainty exists if the information available to the taxpayer does not establish the capability of development or improvement, method of development or improvement, or the appropriateness of the business component’s design.

- Process of Experimentation: The taxpayer must undergo a systematic process designed to evaluate one or more alternatives to achieve a result where the capability or the method of achieving that result, or the appropriate design of that result, is uncertain at the beginning of the taxpayer’s research activities.

- Technological in Nature: The process of experimentation used to discover information must fundamentally rely on principles of hard science such as physical or biological sciences, chemistry, engineering or computer science.

What records and specific documentation did IVO Tech keep?

Similar to any tax credit or deduction, IVO had to save business records that outlined what it did in its R&D activities, including experimental activities and documents to prove that the work took place in a systematic manner. IVO saved the following documentation as evidence:

- Innovation Log

- Records of changes and bug fixes

- Photographs/ videos of testing

- Testing protocols

- Results or records of analysis from testing/ trial runs

- Tax invoices

- Receipts

- Labor time sheets

By having these records on file, IVO confirmed that it was ‘compliance ready’ — meaning if it was audited by the IRS, it could present documentation that illustrated the progression of its R&D activity, therefore proving its R&D eligibility.

Click here to view the PDF version of this case study.

An Austin-based software developer began operations in 2017. The Company has steadily increased its research expenditures primarily through the addition of both experienced and inexperienced developers. The client has been claiming the federal R&D Tax Credit since 2022 and the Texas R&D Tax Credit beginning for tax year ended December 31, 2025.

| FEDERAL | TEXAS | |||||

| Year | Total QREs | Credit | Total QREs | Credit | ||

| 2026 | $900.000,00 | $90.000,00 | $900.000,00 | $29.430,00 | ||

| 2025 | $750.000,00 | $75.000,00 | $750.000,00 | $25.950,00 | ||

| 2024 | $550.000,00 | $55.000,00 | $550.000,00 | N/A | ||

| 2023 | $220.000,00 | $22.000,00 | $220.000,00 | N/A | ||

| Total | $2.420.000,00 | $242.000,00 | $2.420.000,00 | $55.380,00 | ||

Choose your state