Arkansas R&D Tax Credit Filing Instructions

To claim the R&D tax credit in Arkansas, businesses must first apply with the Arkansas Economic Development Commission (AEDC) or the Arkansas Science and Technology Authority (ASTA), depending on the specific research and development program they qualify for (e.g., in-house research, university-based research, or strategic value research). This application typically requires a detailed project plan outlining the intent, expenditures, start and end dates, and estimated total costs of the R&D activities. Upon approval of the application, the ASTA will issue a Certificate of Tax Credit. To make the actual state R&D tax credit claim, businesses must attach a copy of this Certificate of Tax Credit to their Arkansas income tax return. It is crucial to note that while there is a federal Form 6765 for claiming federal R&D credits, the state of Arkansas does not have a similarly numbered, standalone form for the claim itself; instead, the issued Certificate of Tax Credit serves as the primary documentation to be filed with the state tax return.

Arkansas Patent of the Year – 2024/2025

Radius Group LLC has been awarded the 2024/2025 Patent of the Year for their innovation in commercial lending. Their invention, detailed in U.S. Patent No. 11875402, titled ‘System and method to create and operate an electronic marketplace of trusted banks for participation in commercial loans too large for an individual bank’, introduces a digital platform that enables small and medium-sized banks to collaboratively fund large commercial loans.

The patented system addresses the challenge faced by smaller banks in participating in substantial loans beyond their individual capacity. By creating a secure online marketplace, the platform allows these banks to pool resources, share risks, and collectively fund loans that would otherwise be unattainable. This collaborative approach enhances the banks’ ability to compete with larger financial institutions in the commercial lending sector.

Key features of the system include automated access to bank profiles, performance histories, and metrics, facilitating informed decision-making among participating banks. The platform also supports the syndication of loans, enabling banks to resell their participation interests in closed and funded loans. This functionality promotes liquidity and flexibility within the lending market.

Radius Group’s innovation has the potential to democratize access to large-scale commercial financing, empowering smaller banks to serve a broader range of clients and contribute to economic growth.

Study Case

Natural Glow produces quality organic skincare made of the purest ingredients direct from distillers and growers around the world. The company continuously improves its existing ingredients through researching new filtration methods and extraction processes for aromatherapy and skin care. The company uses base ingredients as well as aromatherapy oils to ensure the therapeutic value, safety for use and appeal to users.

Due to the nature of its work, Natural Glow constantly performs R&D activities. For this particular project, Natural Glow believed that new products could be developed by reformulating existing ingredients on the condition that sufficient research and testing was performed to ensure that the products were safe for human use while meeting all the appropriate expectations.

To qualify for the Research and Experimentation Tax Credit, Natural Glow had to make sure its “qualified research” met four main criteria, known and developed by Congress as The Four-Part Test. After self-assessing, Natural Glow declared the following experiments as R&D work.

Design and development of a series of prototypes to achieve the technical objectives (design and development of the new product range).

The hypothesis for this experiment stated that designing, testing and evaluating various concepts would contribute to a more efficient and effective prototype testing phase.

Natural Glow conducted multiple experiments to try and create top-of-the-line products. It then concluded that such a design was feasible, but needed to be prototyped and fully tested to prove the hypothesis.

Trials and analysis of data to achieve results that can be reproduced to a satisfactory standard and to test the hypothesis (prototype development and testing of the new product range).

Natural Glow’s hypothesis for this phase of experimentation was that developing and implementing various designed components would allow refinement and tweaking of the final result to achieve the objectives of the project.

Natural Glow’s testing proved that the theoretical conclusions from the design phase could be realized through prototype development and related tests. The new knowledge generated would be used for further iterations of design and development and further field testing.

Background research to evaluate current knowledge gaps and determine feasibility (background research for the new product range).

Natural Glow’s background research included:

- Literature search and review.

- Field trips to India and Greece to locate, source and conduct preliminary testing of potential ingredients; to analyze competitors.

- Analysis of consumer behavior and wants (i.e. anti-aging).

- Consultation with industry professionals and potential customers to determine the level of interest and commercial feasibility of such a project.

- Preliminary equipment and resources review with respect to capacity, performance and suitability for the project.

- Consultation with key component/part/assembly suppliers to determine the factors they considered important in the design, and to gain an understanding of how the design needed to be structured accordingly.

The activities conducted in the background research were necessary because they assisted in identifying the key elements of the research project, therefore qualifying as R&D.

Ongoing analysis of customer or user feedback to improve the prototype design (feedback R&D of the new product range).

Natural Glows’ qualifying R&D activities included:

- Ongoing analysis and testing to improve the efficiency and safety of the project.

- Ongoing development and modification to interpret the experimental results and draw conclusions that served as starting points for the development of new hypotheses.

- Commercial analysis and functionality review.

- Consumer trials and feedback.

- Industry evaluations.

These activities were necessary to evaluate the performance capabilities of the new design in the field and to improve any flaws.

Qualified research consists of research for the intent of developing new or improved business components. A business component is defined as any product, process, technique, invention, formula, or computer software that the taxpayer intends to hold for sale, lease, license, or actual use in the taxpayer’s trade or business.

The Four-Part Test

Activities that are eligible for the R&D Credit are described in the “Four-Part Test” which must be met for the activity to qualify as R&D.

- Permitted Purpose: The purpose of the activity or project must be to create new (or improve existing) functionality, performance, reliability, or quality of a business component.

- Elimination of Uncertainty: The taxpayer must intend to discover information that would eliminate uncertainty concerning the development or improvement of the business component. Uncertainty exists if the information available to the taxpayer does not establish the capability of development or improvement, method of development or improvement, or the appropriateness of the business component’s design.

- Process of Experimentation: The taxpayer must undergo a systematic process designed to evaluate one or more alternatives to achieve a result where the capability or the method of achieving that result, or the appropriate design of that result, is uncertain at the beginning of the taxpayer’s research activities.

- Technological in Nature: The process of experimentation used to discover information must fundamentally rely on principles of hard science such as physical or biological sciences, chemistry, engineering or computer science.

What records and specific documentation did Natural Glow keep?

Similar to any tax credit or deduction, Natural Glow had to save documents that outlined what it did in its R&D activities, including experimental activities and business records to prove that the work took place in a systematic manner.

Unfortunately, the only records that Natural Glow saved were literature reviews and background research.

As a company claiming R&D, you always want to be “compliance ready” — meaning if you were audited by the IRS, you could present documentation to show the progression of your R&D work. Here are some types of documentation that would be beneficial to save:

- Project records/ lab notes

- Photographs/ videos of various stages of build/ assembly/ testing

- Prototypes

- Testing protocols

- Results or records of analysis from testing/ trial runs

- Tax invoices

- Patent application number

- Meeting notes or progress reports

A medical research company in Fort Smith, Arkansas had never claimed the R&D Tax Credits before. This project involved the tax year 2025. The Company qualified for the federal R&D Tax Credit of $50,000 and an additional $66,000 of state R&D Tax Credit in Arkansas.

| FEDERAL | ARKANSAS | |||||

| Year | Total QREs | Credit | Total QREs | Credit | ||

| 2025 | $500.000,00 | $50.000,00 | $200.000,00 | $66.000,00 | ||

Choose your state

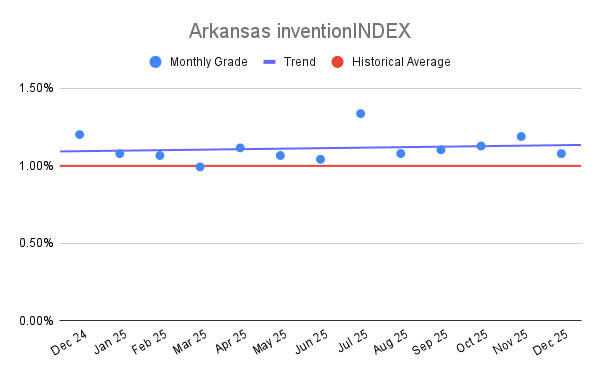

Arkansas inventionINDEX December 2025:<

Arkansas inventionINDEX December 2025:<  Arkansas inventionINDEX Novembe

Arkansas inventionINDEX Novembe