Examples of Qualifying and Non-Qualifying R&D Activities

As the cut-off for lodgement of R&D tax claims approaches, companies should now be turning their focus to the preparation and registration of their R&D tax credit claim for 2015. Nonetheless, the fact remains that there is still quite a bit of confusion around what can and cannot be claimed.

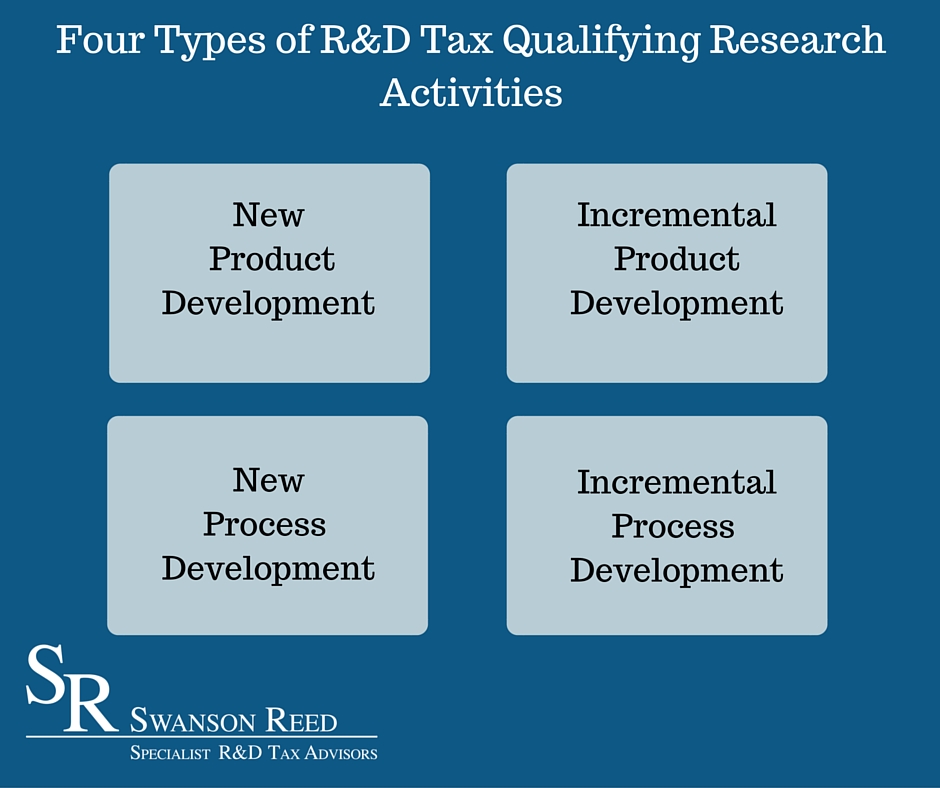

To begin with, qualifying R&D activities generally fall into one of four general categories (see infographic below).

In relation to the above, it is important to note that ‘new’ or ‘incremental’ is determined as related to an individual company, rather than the industry or the world.

Additional examples of qualifying activities include:

- Design and development of new products – particularly products that are safer, more effective or have increased functionality, better performance or longer shelf life;

- research of new applications for existing products;

- testing for compliance with domestic or foreign regulatory requirements;

- design, development and implementation of new reagents, testing methods or protocols;

- product experimentation and modification to increase yield or decrease reaction times;

- improvement of manufacturing or production technologies, processes, techniques or procedures to increase yield, reduce waste and byproducts, improve safety, improve energy efficiency or comply with regulatory requirements;

- design and development of scaled-up manufacturing processes;

- development of prototype pilot batches of new product candidates for testing and validation;

- implementation of automated processes or robotics to increase production efficiency;

- Software development or information technology initiatives related to product or process improvements; and

- research to receive International Organization for Standardization certifications, fertilizer safety or other similar certifications.

When claiming for the R&D tax credit, the following activities are unlikely to have a link to R&D activities and thus considered non-qualifying activities. Typically, these activities would relate to general company operating expenditure that the company would undertake regardless of R&D activities.

- routine testing or inspection activities for quality control;

- development related purely to aesthetic properties of a product or packaging;

- testing and qualification of production lines;

- production line modifications which don’t involve technical uncertainty, i.e. trouble shooting involving detecting faults in production equipment or processes;

- market research for advertising or promotions;

- routine data collections;

- research conducted outside the U.S., Puerto Rico or any possession of the U.S.;

- research that is funded by a third party other than the taxpayer; and

- any other activities that don’t meet all of the four tests previously outlined.

Undeniably, the rules and regulations surrounding the R&D tax credit may be bewildering for some. Hence, a company may wish to seek external assistance to help identity their R&D eligible activities. Many accountants are not acquainted with the ins-and-outs of the R&D Tax, thus you may wish to consider a consultant that specialises in the area. Swanson Reed specialises in the R&D Tax Credit – contact us today to discuss your eligibility and learn more about how the R&D Tax Incentive may benefit your business.