Hawaii R&D Tax Credit Filing Instructions

To claim the Research and Development (R&D) tax credit in Hawaii, businesses generally need to meet specific eligibility requirements, primarily being a “Qualified High Technology Business” (QHTB) as defined by Hawaii Revised Statutes Section 235-7.3(c). This typically means conducting over 50% of activities in qualified research within Hawaii, being registered to do business in the state, and having fewer than 500 employees. Taxpayers must first claim the federal R&D tax credit under IRC Section 41 for the same qualified research expenses (QREs) to be eligible for the Hawaii credit.

The process involves several steps:

- Certification from the Department of Business, Economic Development, and Tourism (DBEDT): Businesses must submit Form N-346A (Application for Certification of Tax Credit for Research Activities) to the DBEDT. This form, along with supporting documentation detailing the qualified research expenditures, is typically due by March 31st following the taxable year in which the research was conducted.

- Annual Survey: QHTBs claiming the credit are also required to complete and file an annual survey electronically with the DBEDT by June 30th of each calendar year following the calendar year in which the credit may be claimed. Failure to submit this survey can result in a waiver of the credit.

- Claiming the Credit on Tax Return: Once the DBEDT certifies the credit, they will issue a certificate. This certificate, along with Hawaii Form N-346 (Tax Credit for Research Activities) and a copy of the federal Form 6765 (Credit for Increasing Research Activities), must be attached to the taxpayer’s Hawaii income tax return (e.g., Form N-11 for individuals, N-20 for partnerships, N-35 for S corporations, etc.). The deadline to claim the credit, including amended claims, is generally 12 months after the close of the taxable year.

It’s important to note that the Hawaii R&D tax credit program was set to expire on December 31, 2024, unless further legislation was passed. Therefore, it is crucial to verify the current status of the program and any updated requirements with the Hawaii Department of Taxation or the DBEDT.

Hawaii Patent of the Year – 2024/2025

Nalu Scientific LLC has been awarded the 2024/2025 Patent of the Year for its breakthrough in high-speed data acquisition. Their invention, detailed in U.S. Patent No. 12052026, titled ‘System and method for high-sample rate transient data acquisition with pre-conversion activity detection’, introduces a novel approach to capturing fleeting events in scientific measurements.

This patented system enhances the precision of data collection by identifying and isolating significant signals before they undergo digital conversion. By focusing on these critical moments, the technology ensures that even the briefest occurrences are accurately recorded. This capability is particularly valuable in fields like particle physics and emerging technologies such as Lidar, where understanding rapid, transient events is crucial.

Traditional data acquisition methods often struggle to capture these swift phenomena due to limitations in sampling rates and detection capabilities. Nalu Scientific’s innovation addresses these challenges by integrating pre-conversion activity detection, allowing for high-resolution sampling without data loss. The system’s design not only improves the fidelity of measurements but also reduces overall system costs by streamlining the data acquisition process.

With applications spanning from advanced scientific research to industrial diagnostics, this technology represents a significant advancement in the field. Nalu Scientific’s invention promises to enhance the accuracy and efficiency of transient data acquisition, paving the way for deeper insights and innovations across various industries.

Study Case

ViewLine Productions (ViewLine) is an American, full-service media company specializing in film production and interactive media integration. As part of the film and media industry, ViewLine Productions is constantly focusing on new product development to remain competitive in the field. It is regularly conducting R&D activities to come up with new technologies to produce the highest quality media products.

To keep up with client demand and the competitive nature of the industry, ViewLine Productions began to reinvent their equipment to produce highly innovative products, special effects and alternative delivery channels.

ViewLine Productions had never claimed the R&D tax credit before, and was unaware that it was performing qualified research and development. To be eligible for the credit, ViewLine had to satisfy four main criteria, known as the 4-Part Test. After consulting a specialist, ViewLine realized it was eligible for the R&D Tax Credit.

The R&D tax credit specialist helped ViewLine determine its qualifying R&D activities, many of which were part of the company’s daily operations. ViewLine’s qualified research expenses (QRE) included:

- Development of new or improved products to meet changing consumer preferences;

- Development of visual effects and animation;

- Development of new media asset management systems;

- New software technologies for computer gaming;

- Improving web-based systems and interactive media.

ViewLine claimed the federal R&D tax credit and was granted more than $150,000 in credits. A sustainable methodology was also established to help the company identify, document and substantiate eligible R&D projects and costs on an ongoing basis.

Qualified research consists of research for the intent of developing new or improved business components. A business component is defined as any product, process, technique, invention, formula, or computer software that the taxpayer intends to hold for sale, lease, license, or actual use in the taxpayer’s trade or business.

The Four-Part Test

Activities that are eligible for the R&D Credit are described in the “Four-Part Test” which must be met for the activity to qualify as R&D.

- Permitted Purpose: The purpose of the activity or project must be to create new (or improve existing) functionality, performance, reliability, or quality of a business component.

- Elimination of Uncertainty: The taxpayer must intend to discover information that would eliminate uncertainty concerning the development or improvement of the business component. Uncertainty exists if the information available to the taxpayer does not establish the capability of development or improvement, method of development or improvement, or the appropriateness of the business component’s design.

- Process of Experimentation: The taxpayer must undergo a systematic process designed to evaluate one or more alternatives to achieve a result where the capability or the method of achieving that result, or the appropriate design of that result, is uncertain at the beginning of the taxpayer’s research activities.

- Technological in Nature: The process of experimentation used to discover information must fundamentally rely on principles of hard science such as physical or biological sciences, chemistry, engineering or computer science.

What records and specific documentation did Wino keep?

Similar to any tax credit or deduction, Wino had to save business records that outlined what it did in its R&D activities, including experimental activities and documents to prove that the work took place in a systematic manner.

Wino saved the following documentation:

- Progress of project (e.g. meeting notes, minutes, emails, reports)

- Conceptual sketches and technical drawings

- Photographs of completed models

- Testing protocols

- Results or records of analysis from testing / trial runs

- Tax invoices

By having these records on file, Wino confirmed that it was “compliance ready” — meaning if it was audited by the IRS, it could present documentation to show the progression of its R&D work, ultimately proving its R&D eligibility.

A Honolulu optical communications company had never before claimed the R&D Tax credit. This project involved a 2025 year study.

The company qualified for the federal R&D Tax Credits of $120,000 and an additional refundable credit of $170,000 in Hawaii state R&D Tax Credits.

| FEDERAL | HAWAII | |||||

| Year | Total QREs | Credit | Total QREs | Credit | ||

| 2025 | $1.200.000,00 | $120.000,00 | $850.000 | $170.000,00 | ||

Choose your state

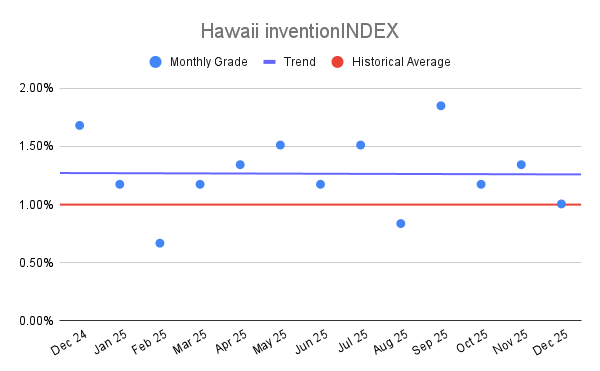

Hawaii inventionINDEX December 2025:

Hawaii inventionINDEX December 2025: Hawaii inventionINDEX November 20

Hawaii inventionINDEX November 20