Illinois R&D Tax Credit Filing Instructions

To claim the Research and Development (R&D) tax credit in Illinois, businesses must engage in qualified research activities as defined under Section 41 of the Internal Revenue Code, specifically those performed within the state. The Illinois R&D credit is a nonrefundable credit equal to 6.5% of the qualifying expenditures that exceed a base amount, which is the average of the qualifying research expenditures (QREs) for the three preceding taxable years. These qualifying expenditures typically include wages for qualified services, the cost of supplies, and rental or lease costs of computers, as well as contract research expenses.

Businesses must file Illinois Schedule 1299-D, Income Tax Credits (for corporations and fiduciaries), or Schedule 1299-A, Tax Subtractions and Credits for Partnerships and S Corporations, depending on their entity type. This schedule must be attached to their appropriate Illinois tax return, such as Form IL-1120 (for corporations), Form IL-1041 (for fiduciaries), or Form IL-990-T (for unrelated business income tax). Unused credits can generally be carried forward for up to five years. It’s essential for businesses to maintain thorough documentation of their R&D activities and expenses to support their claim in the event of an audit.

Illinois Patent of the Year – 2024/2025

Mental Health Technologies Inc. has been awarded the 2024/2025 Patent of the Year for its innovative approach to mental health treatment optimization. Their invention, detailed in U.S. Patent No. 11894146, titled ‘Systems and methods for allocating resources in mental health treatment’, introduces a data-driven method to personalize and enhance mental health care delivery.

This patented system leverages advanced algorithms to analyze individual patient profiles, incorporating data such as symptoms, medical history, and treatment responses. By computing a personalized wellness score and tracking its progression over time, the system assesses treatment efficacy on an individual level. It then compares these metrics across a broader patient population with similar conditions to identify patterns and correlations.

Utilizing this comparative analysis, the system can recommend tailored treatment regimens, optimizing resource allocation to improve patient outcomes. Factors influencing treatment success, both fixed and variable, are considered to adjust strategies dynamically. This approach not only aims to enhance the effectiveness of mental health interventions but also seeks to allocate resources more efficiently, ensuring that patients receive the most appropriate care based on their unique needs.

By integrating comprehensive data analysis into the treatment planning process, Mental Health Technologies Inc.’s innovation represents a significant advancement in personalized mental health care, with the potential to improve both patient experiences and clinical outcomes.

Study Case

Nut & Co. was started in 1988 to design and build equipment to fulfill the needs of the pecan grower and sheller.

The owner of Nut & Co. began his pecan career in 1972. Since the very first day an effort to help build the industry stronger has always been in the forefront of the company. Designing and manufacturing high-quality, reliable equipment has helped build a company that each year continues to be a leader in the industry.

Nut & Co. incurred qualified research expenses under IRC Section 41 relating to the design and development of various cultivation, support, processing and separation equipment during the 2013-2016 fiscal years. Its biggest R&D project was the development of the Aspirator System.

The Aspirator System was designed in 2012 to fit both small and larger shellers. At the time, the industry used blowers to separate shell from pecan meat. This process was inefficient and produced a lot of dust within the plant. The aspirator system was designed to use suction methods instead of blowing. This kept the plant clean and accomplished the remarkable task of removing the shell from the pecan meat.

In order to qualify for the Research and Development Tax Credit, Nut & Co. needed to determine the eligibility of its proposed R&D activities. The qualified research must meet four main criteria, known as the Four-Part Test. Nut & Co.’s qualified R&D activities included the following.

Design and development of a series of prototypes to achieve the technical objectives (design of the aspirator system).

Nut & Co.’s hypothesis for this activity stated that it was possible to develop a revolutionary piece of shelling equipment that could remove the meat from the pecan shell by using a suction method instead of the normal blowing method.

The experiments that Nut & Co. conducted in the design phase predominantly entailed conceptual engineering drawings, mathematical calculations and testing of different materials. These experiments could only be proven effective or ineffective in the prototype development and testing phase. Following the experiments in that phase, during which the product was built and tested in various applications, the design was modified and retested until the desired outcome was achieved.

Trials and analysis of data to achieve results that can be reproduced to a satisfactory standard (development and testing of the aspirator system).

The main objective for this activity stated that with improved knowledge of the intrinsic factors related to the extraction of pecans from their shells, it was possible to identify mechanisms for improving the current shelling process.

Details of this experiment included testing of different materials ultimately concluding that stainless steel wasp, off-fall tanks and galvanized piping needed to be used for the system to ensure efficiency, accuracy and safety.

Background research to evaluate current knowledge gaps and determine feasibility (background research of the development of the aspirator system).

Prior to 2013, the shelling equipment existing on the market was cumbersome and expensive. Thus, besides the lack of comparable solutions available, the outcomes of activities in this research could not have been known or determined in advance due to a number of specific technical challenges.

Nut & Co.’s eligible R&D activities during this phase of experimentation included:

- Literature search and review, including maintaining up-to-date knowledge on relevant certification and standards.

- Consultation with industry professionals and potential customers to determine the level of interest and commercial feasibility of the product.

- Preliminary equipment and resources review with respect to capacity, performance and suitability for the project.

- Consultation with key component/part/assembly suppliers to determine the factors they considered important in the design and to gain an understanding of how the design needed to be structured accordingly.

The background research conducted by Nut & Co. was directly related to the main objective of designing the aspirator system, therefore qualifying as R&D.

Ongoing analysis of customer or user feedback to improve the prototype design (feedback R&D of the aspirator system).

Nut & Co.’s eligible R&D activities for this phase of its project included:

- Ongoing analysis and testing to improve the efficiency and safety of the product.

- Ongoing development and modification to interpret the experimental results and draw conclusions that served as starting points for the development of new hypotheses.

- Commercial analysis and functionality review.

These activities were necessary to evaluate the performance capabilities of the new design in the field and to improve any flaws in the design, therefore qualifying as R&D.

Qualified research consists of research for the intent of developing new or improved business components. A business component is defined as any product, process, technique, invention, formula, or computer software that the taxpayer intends to hold for sale, lease, license, or actual use in the taxpayer’s trade or business.

The Four-Part Test

Activities that are eligible for the R&D Credit are described in the “Four-Part Test” which must be met for the activity to qualify as R&D.

- Permitted Purpose: The purpose of the activity or project must be to create new (or improve existing) functionality, performance, reliability, or quality of a business component.

- Elimination of Uncertainty: The taxpayer must intend to discover information that would eliminate uncertainty concerning the development or improvement of the business component. Uncertainty exists if the information available to the taxpayer does not establish the capability of development or improvement, method of development or improvement, or the appropriateness of the business component’s design.

- Process of Experimentation: The taxpayer must undergo a systematic process designed to evaluate one or more alternatives to achieve a result where the capability or the method of achieving that result, or the appropriate design of that result, is uncertain at the beginning of the taxpayer’s research activities.

- Technological in Nature: The process of experimentation used to discover information must fundamentally rely on principles of hard science such as physical or biological sciences, chemistry, engineering or computer science.

What records and specific documentation did Nut & Co. keep?

Similar to any tax credit or deduction, Nut & Co. had to save business records that outlined what it did in its R&D activities, including experimental activities and documents to prove that the work took place in a systematic manner. Nut & Co. saved the following documentation:

Project records/ lab notes

Innovation Log

Conceptual sketches

Design drawings

Background research

Records of changes

Testing protocols

Results of records of analysis from testing/trial runs

Records of resource allocation/usage logs

Staff time sheets

Invoices

Receipts

By having these records on file, Nut & Co. confirmed that it was “compliance ready” — meaning if it was audited by the IRS, it could present documentation to show the progression of its R&D work, ultimately proving its R&D eligibility.

R&D Tax Credit Summary

Nut & Co. shows continuous improvements through research and development in the following areas:

Improvements to production time and efficiency

Improvements in reliability of products

Decrease in labor and production costs

Production innovation sourced from:

Internal ideas

Existing customers who have business needs which require new solutions

Nut & Co. eliminated uncertainty by:

Testing across all supported releases to determine reliability and user-friendliness

Experimentation with possible fixes until an adequate solution was determined

Therefore, Nut & Co. satisfies the four-part test and qualifies for both the Federal and State research and development tax credit. By filing both the federal and state research and development tax credits, Nut & Co. was able to obtain a significant amount of credit for tax years 2013-2016.

A Chicago company manufactures components for farming equipment. The company claims research credits each year for the design and development activities of its engineers as well as the prototype supplies used in conducting research. This project involved a four year study with a three year look back.

The company qualified for the federal R&D Tax Credit of $276,755 and an additional $78,210 in Illinois state research credit.

| FEDERAL | ILLINOIS | |||||

| Year | Total QREs | Credit | Total QREs | Credit | ||

| 2026 | $1.050.000,00 | $102.480,00 | $1.050.000,00 | $26.880,00 | ||

| 2025 | $800.000,00 | $80.960,00 | $800.000,00 | $23.200,00 | ||

| 2024 | $550.000,00 | $59.015,00 | $550.000,00 | $19.030,00 | ||

| 2023 | $350.000,00 | $34.300,00 | $350.000,00 | $9.100,00 | ||

| Total | $2.750.000,00 | $276.755,00 | $2.750.000,00 | $78.210,00 | ||

Choose your state

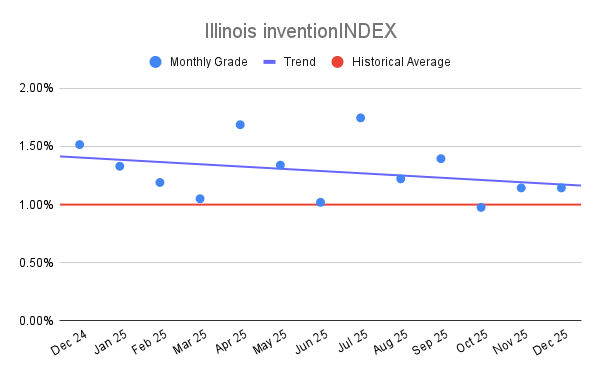

Illinois inventionINDEX December 2025:<

Illinois inventionINDEX December 2025:<  Illinois inventionINDEX Novemb

Illinois inventionINDEX Novemb