Iowa R&D Tax Credit Filing Instructions

To claim the Research Activities Credit (R&D tax credit) in Iowa, businesses must first claim the federal R&D tax credit on Federal Form 6765, Credit for Increasing Research Activities. Subsequently, they need to file the appropriate Iowa state form. If a taxpayer elects to claim the regular Research Activities Tax Credit, they must file Iowa Form IA 128. Alternatively, if they choose the Alternative Simplified Research Activities Tax Credit, they should file Iowa Form IA 128S. These forms, along with supporting documentation for qualified research expenses incurred within Iowa, must be submitted with the taxpayer’s Iowa income tax return by the due date. Eligibility generally requires the business to be engaged in certain industries like manufacturing, life sciences, agriscience, software engineering, or aviation and aerospace.

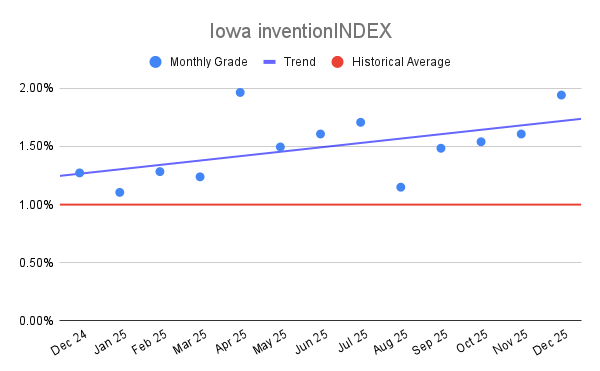

Iowa Patent of the Year – 2024/2025

Bristola LLC has been awarded the 2024/2025 Patent of the Year for its innovative approach to cleaning inaccessible floors. Their invention, detailed in U.S. Patent No. 11883863, titled ‘Auger cleaned inaccessible floor system’, introduces a novel method for maintaining cleanliness in areas that are typically difficult to access.

This patented system features a floor equipped with a channel extending horizontally beneath its lowest point. The channel is designed to accommodate an auger cleaner, which is delivered via a gate complex connected to a box. When the gate is opened, the auger cleaner is inserted into the channel, allowing it to agitate and transport waste to a waste pipe for disposal. This design enables cleaning of the floor without the need for human entry, reducing labor costs and enhancing safety.

Additionally, the system includes a boom that facilitates the movement of the auger cleaner within the channel, and a sump pump to remove any fluid from the box. The integration of these components allows for efficient cleaning operations while maintaining the operational capacity of the floor system.

Bristola LLC’s innovation addresses a significant challenge in maintaining cleanliness in inaccessible areas, offering a safer and more efficient solution for industries requiring such systems.

Study Case

Raceway Engineering (Raceway) is an automotive company that specializes in building engines for off-road speedway sprint cars.

To stay at the top of the market, Raceway is always conducting R&D work to assist in the creation of innovative ideas and products. Raceway decided it wanted to come up with a new modified version of its V8 super engine to use in its first futuristic car. The new engine would be based on the company’s previous engine, with updates and improvements.

Raceway launched an R&D project with the following hypothesis:

“The V8 super engine can be improved in terms of performance and fuel economy, while meeting safety regulations and outperforming competitors’ engines.”

Raceway needed to determine the eligibility of its proposed R&D activities in order to know if they qualified for the Research and Experimentation Tax Credit. To be eligible, Raceway had to be certain that its “qualified research” met four main criteria, known and developed by Congress as the Four-Part Test. After self-assessing, Raceway decided to register four R&D activities.

Design and development of a series of prototypes to achieve the technical objectives and prove the hypothesis (design of the modifications to the V8 super engine).

The hypothesis for this activity stated that it was feasible to design an improved and highly functioning V8 super engine that could outperform its competitors.

To try and prove the hypothesis, Raceway designed and redesigned multiple methods and engine parts during this phase.

Trials and analysis of data to achieve results that can be reproduced to a satisfactory standard (prototype development and testing of the V8 super engine).

Raceway’s hypothesis stated that the theoretical conclusions from the design phase could be realized through comprehensive and valid testing.

Raceway trialed the engine in a workshop environment and in the field to test for functionality, efficiency, accuracy and safety.

Background research to evaluate current knowledge gaps and determine feasibility (background research for the modification of the V8 engine).

Raceway conducted the following experiments during its research phase:- Literature search and review, including maintaining awareness of changing legislation in the different states and zones

- Consultation with industry professionals and potential customers to determine the level of interest and commercial feasibility of such a project

- Preliminary equipment and resources review with respect to capacity, performance and suitability for the project

- Consultation with key experts to determine the factors they considered important in the design, and to gain an understanding of how the design needed to be structured accordingly

Ongoing analysis of customer or user feedback to improve the prototype design (feedback R&D of the modifications of the V8 engine).

Raceway’s eligible R&D work during this phase of experimentation included:

- Ongoing analysis and testing to improve the efficiency and safety of the project.

- Ongoing development and modification to interpret the experimental results and draw conclusions that served as starting points for the development of new hypotheses.

- Commercial analysis and functionality review.

These activities were considered “qualified research” because they were necessary to evaluate the performance capabilities of the new design in the field and to improve any flaws in the design.

Qualified research consists of research for the intent of developing new or improved business components. A business component is defined as any product, process, technique, invention, formula, or computer software that the taxpayer intends to hold for sale, lease, license, or actual use in the taxpayer’s trade or business.

The Four-Part Test

Activities that are eligible for the R&D Credit are described in the “Four-Part Test” which must be met for the activity to qualify as R&D.

- Permitted Purpose: The purpose of the activity or project must be to create new (or improve existing) functionality, performance, reliability, or quality of a business component.

- Elimination of Uncertainty: The taxpayer must intend to discover information that would eliminate uncertainty concerning the development or improvement of the business component. Uncertainty exists if the information available to the taxpayer does not establish the capability of development or improvement, method of development or improvement, or the appropriateness of the business component’s design.

- Process of Experimentation: The taxpayer must undergo a systematic process designed to evaluate one or more alternatives to achieve a result where the capability or the method of achieving that result, or the appropriate design of that result, is uncertain at the beginning of the taxpayer’s research activities.

- Technological in Nature: The process of experimentation used to discover information must fundamentally rely on principles of hard science such as physical or biological sciences, chemistry, engineering or computer science.

What records and specific documentation did Raceway keep?

Similar to any tax credit or deduction, Raceway had to save business records that outlined what it did in its R&D activities, including experimental activities and documents to prove that the work took place in a systematic manner. Raceway saved the following documentation:

- Literature review

- Meeting notes

- Sketches/drawings

- Photos

- Screen shots

- Test protocols

- Test results and analysis

- Customer feedback

- Field-test results

By having these records on file, Raceway confirmed that it was “compliance ready” — meaning if it was audited by the IRS, it could present documentation to show the progression of its R&D work.

A Company that has a development and design facility in the automotive field in Iowa had previously taken the R&D Tax Credit, but had not done so in recent years. This project involved a three year study.

The Company qualified for the federal R&D Tax Credit of $121,810 and an additional $33,452 in refundable Iowa state R&D Tax Credit.

| FEDERAL | IOWA | |||||

| Year | Total QREs | Credit | Total QREs | Credit | ||

| 2026 | $1.200.000,00 | $48.000,00 | $1.200.000,00 | $15.492,00 | ||

| 2025 | $800.000,00 | $26.800,00 | $800.000,00 | $8.720,00 | ||

| 2024 | $1.400.000,00 | $47.040,00 | $550.000,00 | $9.240,00 | ||

| Total | $3.400.000,00 | $121.810,00 | $3.400.000,00 | $33.452,00 | ||

Choose your state