Kentucky Patent of the Year – 2024/2025

Blunt Wrap U.S.A. Inc. and North Atlantic Wrap Company LLC has been awarded the 2024/2025 Patent of the Year for their innovative approach to cigar construction. Their invention, detailed in U.S. Patent No. 11903408, titled ‘Smoking article and method’, introduces a novel method for manufacturing cigars using nested frusto-conically shaped tubes.

This inventive method involves providing multiple nested tubes made of smokable material, such as spirally wrapped tobacco. These tubes are then attached to a mouthpiece with an internally threaded socket. The nested tubes and mouthpiece are packaged together, either filled with tobacco filler material, partially filled, or unfilled, for sale in a container.

The design allows for a customizable smoking experience, as users can choose to fill the tubes with their preferred tobacco blend. The nested structure also facilitates a more efficient manufacturing process, potentially reducing production costs and time. Additionally, the use of a threaded mouthpiece ensures a secure and consistent connection between the cigar and the smoker’s mouth.

Blunt Wrap U.S.A. Inc. and North Atlantic Wrap Company LLC innovative approach to cigar construction represents a significant advancement in the tobacco industry. By combining traditional materials with modern manufacturing techniques, this invention offers both consumers and manufacturers a more versatile and efficient product.

Study Case

Freeman Home Builders (Freeman) is a custom home construction company involved in designing, constructing and managing home builds from conception to delivery.

In 2012, Freeman identified that the inefficiencies that occurred during the building process were a result of poor industry practices, which were manual, resource-intensive and poorly organized.

Freeman saw a need for a new, all-encompassing software that could handle all aspects of its business instead of the existing market technology that focused strictly on design. Freeman formulated a hypothesis for its new R&D project:

“A management system can be designed and developed to manage all aspects of a building project by integrating the functions of design, customer relationship management (CRM) and accounting software.”

The company believed its new management software (FMS) could be achieved by implementing four key Research and Experimentation activities. To be eligible, Freeman had to meet four main criteria, known and developed by Congress as the Four-Part Test.

Design and development of a series of prototypes to achieve the technical objectives (design of FMS).

This activity focused on whether a management system could be designed and developed to manage all aspects of a building project by integrating the functions of design, CRM and accounting software.

After cycles of coding, testing and re-coding, Freeman was able to prove the theoretical feasibility of developing FMS.

Trials and analysis of data to achieve results that can be reproduced to a satisfactory standard and to test the hypothesis (prototype development and testing of FMS).

The hypothesis for this experiment was to prove that theoretical conclusions from the design phase could be realized through the development and testing of FMS, and conclude that a management system could be designed and developed to manage all aspects of a building project by integrating the functions of design, CRM and accounting software.

Background research to evaluate current knowledge gaps and determine feasibility (background research for the design of FMS).

Freeman engaged in background research for three years which included the following activities:

- Literature search and review

- Consultation with industry professionals and potential customers to determine the level of interest and commercial feasibility of such a project

- Preliminary equipment and resources review with respect to capacity, performance and suitability for the project

- Consultation with key component/part/assembly suppliers to determine the factors they considered important in the design and to gain an understanding of how the design needed to be structured accordingly

These activities qualified as R&D because they assisted in identifying the key elements of the research project.

Ongoing analysis of customer or user feedback to improve the prototype design (feedback R&D of FMS).

Freeman’s R&D work at this stage included activities such as ongoing analysis and testing and continuous development and modification to interpret the experimental results.

These activities were necessary to evaluate the performance capabilities of the new design in the field and to improve any flaws in the design, therefore qualifying as R&D work.

Qualified research consists of research for the intent of developing new or improved business components. A business component is defined as any product, process, technique, invention, formula, or computer software that the taxpayer intends to hold for sale, lease, license, or actual use in the taxpayer’s trade or business.

The Four-Part Test

Activities that are eligible for the R&D Credit are described in the “Four-Part Test” which must be met for the activity to qualify as R&D.

- Permitted Purpose: The purpose of the activity or project must be to create new (or improve existing) functionality, performance, reliability, or quality of a business component.

- Elimination of Uncertainty: The taxpayer must intend to discover information that would eliminate uncertainty concerning the development or improvement of the business component. Uncertainty exists if the information available to the taxpayer does not establish the capability of development or improvement, method of development or improvement, or the appropriateness of the business component’s design.

- Process of Experimentation: The taxpayer must undergo a systematic process designed to evaluate one or more alternatives to achieve a result where the capability or the method of achieving that result, or the appropriate design of that result, is uncertain at the beginning of the taxpayer’s research activities.

- Technological in Nature: The process of experimentation used to discover information must fundamentally rely on principles of hard science such as physical or biological sciences, chemistry, engineering or computer science.

What records and specific documentation did Freeman keep?

Similar to any tax credit or deduction, Freeman had to save business records that outlined what it did in its R&D activities, including experimental activities and documents to prove that the work took place in a systematic manner. Freeman saved the following documentation:

- Error log and fixes

- Conceptual sketches

- Technical drawing revisions

- Screenshots of various build versions / final version

- Email correspondence

- Progress reports and meeting minutes

- Staff time sheets

- Tax invoices

- Patent application number

- Backup copies of the program and reports for each release

- Documentation of changes and source code in an online, private revision control system

This is an excellent example of how to be “compliance ready” — meaning if you were selected for an audit by the IRS, you could present documentation to show the progression of your R&D work.

A company constructed a new research facility in Lexington, Kentucky. The company designs and manufactures components for the automobile industry. In addition to the federal R&D Tax Credit it has traditionally claimed, the company claimed state R&D Tax Credits for the construction of a new research facility in 2014. This project involved a multi-year study covering the tax years 2023 – 2026.

The Company qualified for the federal R&D Tax Credits of $289,100 and an additional $160,000 in Kentucky state R&D Tax Credit.

| FEDERAL | KENTUCKY | |||||

| Year | Total QREs | Credit | Total QREs | Credit | ||

| 2026 | $1.200.000,00 | $124.920,00 | $3.200.000,00 | $160.000,00 | ||

| 2025 | $800.000,00 | $80.960,00 | N/A | N/A | ||

| 2024 | $550.000,00 | $53.295,00 | N/A | N/A | ||

| 2023 | $350.000,00 | $29.925,00 | N/A | N/A | ||

| Total | $2.900.000,00 | $289.100,00 | $3.200.000,00 | $160.000,00 | ||

Choose your state

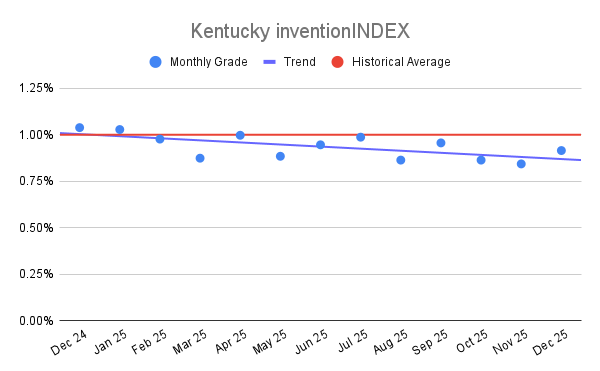

Kentucky inventionINDEX December 2025:<

Kentucky inventionINDEX December 2025:<  Kentuck

Kentuck