Kentucky and the Research and Development (R&D) Tax Credit

For tax years beginning on or after January 1, 2007, Kentucky law permits a credit against income tax and limited liability entity tax (LLET) for the construction of research facilities. “Construction of research facilities” means constructing, remodeling and equipping facilities or expanding existing facilities in this state for qualified research. It includes only tangible, depreciable property, and does not include any amounts paid or incurred for replacement property. The credit is available once the tangible, depreciable property is placed in service.

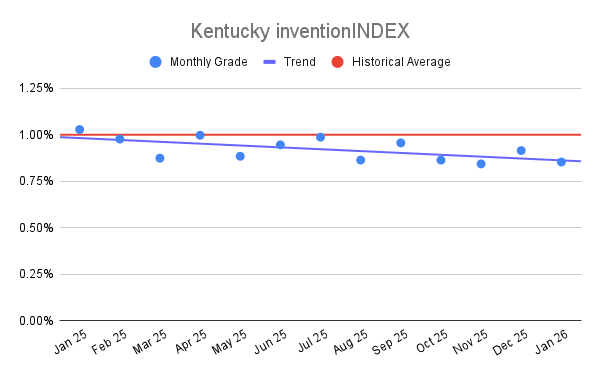

Kentucky inventionINDEX January 2026:<

Kentucky inventionINDEX January 2026:<