Louisiana R&D Tax Credit Filing Instructions

To claim the Research and Development (R&D) tax credit in Louisiana, businesses must first apply for and obtain a credit certification from Louisiana Economic Development (LED). 1 This involves completing an online application, submitting a fee, and providing documentation that details qualified research activities (QRAs) and expenditures incurred in Louisiana. 2 For businesses that file for the Federal R&D tax credit, they typically need to attach their Federal Form 6765, “Credit for Increasing Research Activities.” Once the certification is approved by LED, the business can then claim the tax credits on their Louisiana income tax return. 2 The specific form to be filed with the Louisiana Department of Revenue for the state R&D tax credit claim is Louisiana Form R-620, “Research and Development Tax Credit Claim Form.” This form should be included with the business’s corporate or personal income tax return, depending on its structure. It is crucial to claim the expenditures within one year after December 31 of the tax period in which they were incurred.

Louisiana Patent of the Year – 2024/2025

Advano Inc. has been awarded the 2024/2025 Patent of the Year for their innovative approach to silicon anode materials. Their invention, detailed in U.S. Patent No. 11970401, titled ‘Amorphization of silicon’, introduces a novel process to transform crystalline silicon into amorphous nanoparticles, enhancing the performance and longevity of lithium-ion batteries.

This breakthrough addresses a critical challenge in battery technology: silicon’s tendency to expand and contract during charge cycles, leading to capacity loss and shortened battery life. Advano’s patented method involves milling silicon nanocrystals with a crystallinity greater than 60% to produce amorphous silicon nanoparticles with reduced crystallinity. This structural modification allows for better accommodation of volume changes during battery operation, improving cycle stability and energy density.

Advano’s approach offers a scalable and cost-effective solution, positioning it as a potential game-changer for industries reliant on high-performance batteries, such as electric vehicles and renewable energy storage. By enhancing the structural integrity of silicon anodes, this innovation paves the way for batteries that are not only more efficient but also more durable, contributing to the advancement of sustainable energy technologies.

Study Case

Wino Incorporated (Wino) is a specialist in the field of wine cellar refrigeration. In 2012, Wino was approached by a vineyard to create a solution that would allow them to reduce their operating cellar temperatures from 59℉ to 54℉.

A solution was devised to use the cold liquid CO2 from a CO2 recovery plant by vaporizing the liquid and processing it through the cooling units in the cellar to lower cellar temperatures to 54℉.

To qualify for the Research and Experimentation Tax Credit, Wino had to make sure its “qualified research” met four main criteria, known and developed by Congress as The Four-Part Test. After self-assessing, Wino declared the following experiments as R&D work.

Design and development of a series of prototypes to achieve the technical objectives and prove the hypothesis (design development and initial testing of the solution to reduce cellar temperatures via a C02 system).

The hypothesis for this phase of Wino’s R&D project questioned whether cellar temperatures could be reduced by 5℉ through the use of C02.

As an attempt to prove its hypothesis, Wino conducted the following R&D activities:

- Practical design by in-depth analysis of possible issues

- System design was constantly refined over a period of months to improve system performance

- Technical drawings and design calculations were updated as required to incorporate modifications and refinements

- Implementation of solution onsite for testing and further development

Wino proved that the system was a failure as too many variables which were beyond its control did not allow the system to operate in a consistent manner. With all these factors influencing performance, the system was too complicated for stable operation of the cellars.

Trials and analysis of data to achieve results that can be reproduced to a satisfactory standard and to test the hypothesis (testing and assessment of the practical performance revised solution).

Although Wino was unsuccessful in finding a solution to lower the overall temperature in the wine cellar, it was still able to claim the following tests and assessment activities as R&D:

- A complete change in design was necessary using CO2 as a conventional refrigerant to reduce the cellar temperature.

- Redesign of the system as a standalone plant using two new compressors and pump recirculation of liquid CO2 to larger evaporators in the cellars.

- A new evaporator in each cellar was added to the existing evaporators.

Background research to evaluate current knowledge gaps and determine feasibility (background research for the design of a solution to reduce the cellar temperatures).

Wino’s background research was focused on identifying issues, designing a potential solution using C02 recovery tanks and liaising with the client for design development. Design development included:

- Client meetings, submission of typical designs, other system options and the undertaking to provide refined designs.

- Internal design development and the development of sketches and calculations.

- Discussions with the site operators on system practicality.

- Design submission to the client for their review and acceptance.

These background research activities were necessary because they assisted in identifying the key elements of the research project, therefore qualifying as R&D work.

Ongoing analysis of customer or user feedback to improve the prototype design (feedback R&D of the solution to reduce cellar temperatures via a CO2 system).

Wino conducted the following activities during its analysis:

- Development and modification to interpret the experimental results/observations and draw conclusions that served as starting points for the development of new hypotheses; i.e. solutions to observed inefficiencies or problems

- Assessment of client feedback to improve on design of system

- Client inspection on completion of construction stage

- Validation of the design inputs on operation and testing of the new system

These activities were necessary to evaluate the performance capabilities of the new design in the field and to improve any flaws in the design.

Qualified research consists of research for the intent of developing new or improved business components. A business component is defined as any product, process, technique, invention, formula, or computer software that the taxpayer intends to hold for sale, lease, license, or actual use in the taxpayer’s trade or business.

The Four-Part Test

Activities that are eligible for the R&D Credit are described in the “Four-Part Test” which must be met for the activity to qualify as R&D.

- Permitted Purpose: The purpose of the activity or project must be to create new (or improve existing) functionality, performance, reliability, or quality of a business component.

- Elimination of Uncertainty: The taxpayer must intend to discover information that would eliminate uncertainty concerning the development or improvement of the business component. Uncertainty exists if the information available to the taxpayer does not establish the capability of development or improvement, method of development or improvement, or the appropriateness of the business component’s design.

- Process of Experimentation: The taxpayer must undergo a systematic process designed to evaluate one or more alternatives to achieve a result where the capability or the method of achieving that result, or the appropriate design of that result, is uncertain at the beginning of the taxpayer’s research activities.

- Technological in Nature: The process of experimentation used to discover information must fundamentally rely on principles of hard science such as physical or biological sciences, chemistry, engineering or computer science.

What records and specific documentation did Wino keep?

Similar to any tax credit or deduction, Wino had to save business records that outlined what it did in its R&D activities, including experimental activities and documents to prove that the work took place in a systematic manner.

Wino saved the following documentation:

- Progress of project (e.g. meeting notes, minutes, emails, reports)

- Conceptual sketches and technical drawings

- Photographs of completed models

- Testing protocols

- Results or records of analysis from testing / trial runs

- Tax invoices

By having these records on file, Wino confirmed that it was “compliance ready” — meaning if it was audited by the IRS, it could present documentation to show the progression of its R&D work, ultimately proving its R&D eligibility.

No Previous Years

A company with less than 50 employees incurred $150,000 of R&D expenditures in the tax year 2025 and had no prior year R&D expenditures. In this case. there would be no base year. The calculation would be 30% of the current year’s expenditures.

$150,000 x 30% = $45,000 in 2025 LA R&D credit

1 Previous Year

A company with less than 50 employees incurred $150,000 of R&D expenditures in the tax year 2025 and had $100,000 in the tax year 2024.

The base calculation would be the prior year multiplied by the appropriate percentage ($100,000 x 50%) which would be $50,000. In order to calculate the incremental increase in expenditures, the base calculation is subtracted from the current year. The R&D tax credit is 30% of the incremental increase.

($100,000 x 50%) = $50,000 base calculation ($150,000 – $50,000) = $100,000 incremental increase ($100,000 x 30%) = $30,000 of 2025 LA R&D tax credit.

2 Previous Years

A company with less than 50 employees incurred $150,000 of R&D expenditures in the tax year 2025, $100,000 in the tax year 2024, and $50,000 in the tax year 2023.

The base calculation would be the average of the prior year’s times the appropriate percentage ($100,000 + 50,000/2 x 50%) which would be $37,500. In order to calculate the incremental increase in expenditures, the base calculation is subtracted from the current year. The R&D tax credit is 30% of the incremental increase.

($100,000 + 50,000/2 x 50%) = $37,500 base calculation ($150,000 – $37,500) = $112,500 incremental increase ($112,500 x 30%) = $33,750 of 2025 LA R&D tax credit

Choose your state

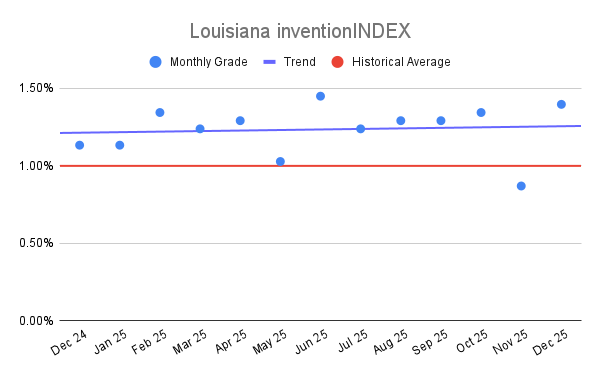

Louisiana inventionINDEX December 2025

Louisiana inventionINDEX December 2025  Louisiana inventionINDEX Nove

Louisiana inventionINDEX Nove