Rhode Island R&D Tax Credit Filing Instructions

To claim the Research and Development (R&D) tax credit in Rhode Island, businesses must calculate their qualified research expenses (QREs) incurred within the state. The credit generally applies to corporations and flow-through entities, with a rate of 22.5% for qualified expenditures up to $111,111, and 16.9% for expenses exceeding this threshold. It’s important to note that the credit utilization is limited to 50% of the tax due after all other applicable credits have been used, and it cannot reduce the tax below the minimum fixed tax rate for corporations. Unused credit amounts can be carried forward for a maximum of seven years. To formally make the state R&D tax credit claim, businesses are required to file Form RI-7695E, Research & Development Expense Credit, and enter the credit amount on Schedule B-CR, Business Entity Credit Schedule, both of which must be attached to their Rhode Island tax return.

Rhode Island Patent of the Year – 2024/2025

EpiVax Inc. has been awarded the 2024/2025 Patent of the Year for their groundbreaking approach to immune modulation. Their invention, detailed in U.S. Patent No. 11911414, titled ‘Regulatory T cell epitopes’, introduces a novel class of peptides designed to enhance immune tolerance.

This innovative technology centers on regulatory T cell epitopes, or “Tregitopes,” which are peptides capable of inducing regulatory T cells to suppress unwanted immune responses. By administering these Tregitopes, the immune system’s activity can be finely tuned, promoting tolerance and preventing overactive immune reactions. This method holds promise for treating autoimmune diseases, allergies, and other conditions where immune modulation is beneficial.

The patent outlines compositions comprising these Tregitopes, including polypeptides derived from specific amino acid sequences. These compositions can be tailored to target various immune pathways, offering a versatile approach to immune system regulation. The potential applications of this technology are vast, ranging from therapeutic interventions to enhancing vaccine efficacy by modulating immune responses.

EpiVax’s advancement in Tregitope-based therapies represents a significant step forward in immunology, providing new avenues for treating immune-related disorders and improving patient outcomes through precise immune system modulation.

Study Case

American Animal Nutrition Organization (AANO) is dedicated to providing natural, non-antibiotic solutions to varied animal health and nutrition issues.

In 2012, AANO decided to take part in an eight-year study to ensure that American beef was a high quality meat that was environmentally responsible, safe and nutritious. AANO created a hypothesis for this program of investigation which stated,

“With knowledge of the intrinsic factors regulating the metabolism of the gastrointestinal tract, we can identify mechanisms for improving feed intake, enhancing feed efficiency and reducing the reliance on antibiotic use.”

The first research phase of AANO’s R&D study involved identifying the intrinsic factors that regulated feed intake in the cow and developing a suitable, low temperature, high moisture pellet that facilitated the ingestion of the feed by cows.

To achieve its technical objectives and overcome the related technical risks, the AANO generated new knowledge at the conclusion of each experimental stage and built upon that knowledge at every stage of the remaining project.

After undergoing its first year of experimentation, AANO needed to determine the eligibility of its proposed R&D activities in order to know if they qualified as Research and Experimentation Tax Credit. To be eligible, AANO had to be certain that its “qualified research” met four main criteria, known and developed by Congress as the Four-Part Test. After self-assessing, AANO decided to register the following R&D expenditures with the IRS.

Design and development of a series of prototypes to achieve the technical objectives and prove the hypothesis (design and adaptation of the chemosensory testing model).

AANO’s main objective for this activity was to determine whether a model for identifying cow preferences based on the chemosensory properties of an ingredient could be designed and developed. This experimentation phase included:

Identification of substances known to have an impact on feed intake and efficiency.

Validation of a model for identifying cow preferences based on the chemosensory properties of an ingredient.

Determination of the statistical sensitivity of the model for identifying the preferences of different ingredients and purification of feed ingredients.

Determining of optimal feed processing conditions for retaining the intake improvement of an ingredient in a commercially relevant cow feed.

Trials and analysis of data to achieve results that can be reproduced to a satisfactory standard (development and testing of feed intake and efficiency enhancers).

The hypothesis for this AANO activity stated that with improved knowledge of the intrinsic factors regulating the metabolism of the gastrointestinal tract, it was possible to identify mechanisms for improving feed intake, enhancing feed efficiency and reducing the reliance on antibiotic use.

Details of this experiment included development of the enhancers based on information gained through the model and testing of the enhancers to ensure efficiency, accuracy and safety.

Background research to evaluate current knowledge gaps and determine feasibility (background research for feed intake and efficiency stimulants).

AANO’s background research included literature search and review, consultations with industry professionals and potential customers, and preliminary equipment and resources review.

The activities conducted during the background research were eligible because they assisted in identifying the key elements of the research project.

Ongoing analysis of customer or user feedback to improve the prototype design (feedback R&D of the feed intake and efficiency enhancers).

AANO’s eligible R&D activity for this phase of its project included:

Ongoing analysis and testing to improve the efficiency and safety of the project.

Ongoing development and modification to interpret the experimental results and draw conclusions that served as starting points for the development of new hypotheses.

Commercial analysis and functionality review.

These activities were necessary to evaluate the performance capabilities of the new design in the field and to improve any flaws in the design, therefore qualifying as R&D.

Qualified research consists of research for the intent of developing new or improved business components. A business component is defined as any product, process, technique, invention, formula, or computer software that the taxpayer intends to hold for sale, lease, license, or actual use in the taxpayer’s trade or business.

The Four-Part Test

Activities that are eligible for the R&D Credit are described in the “Four-Part Test” which must be met for the activity to qualify as R&D.

- Permitted Purpose: The purpose of the activity or project must be to create new (or improve existing) functionality, performance, reliability, or quality of a business component.

- Elimination of Uncertainty: The taxpayer must intend to discover information that would eliminate uncertainty concerning the development or improvement of the business component. Uncertainty exists if the information available to the taxpayer does not establish the capability of development or improvement, method of development or improvement, or the appropriateness of the business component’s design.

- Process of Experimentation: The taxpayer must undergo a systematic process designed to evaluate one or more alternatives to achieve a result where the capability or the method of achieving that result, or the appropriate design of that result, is uncertain at the beginning of the taxpayer’s research activities.

-

Technological in Nature: The process of experimentation used to discover information must fundamentally rely on principles of hard science such as physical or biological sciences, chemistry, engineering or computer science.

What records and specific documentation did AANO keep?

Similar to any tax credit or deduction, AANO had to save business records that outlined what it did in its R&D activities, including experimental activities and documents to prove that the work took place in a systematic manner.

AANO saved the following documentation:

Background research

Project records and laboratory notebooks

Photographs / videos of extrusion process

Testing protocols

Results or analysis from testing / trial runs

Records of resource allocation / usage logs

Tax invoices

By having these records on file, AANO confirmed that it was “compliance ready” — meaning if it was audited by the IRS, it could present documentation to show the progression of its R&D work.

A Providence company designs and manufactures medical instruments for the health services industry. The company claims the R&D Tax Credit each year for the development activities of its engineers. This project involved a multi-year study.

The company qualified for the federal R&D Tax Credits of $234,560 and an additional $311,770 in Rhode Island state R&D Tax Credits.

| FEDERAL | RHODE ISLAND | |||||

| Year | Total QREs | Credit | Total QREs | Credit | ||

| Year 4 | $1.200.000,00 | $96.000,00 | $1.200.000,00 | $126.480,00 | ||

| Year 3 | $800.000,00 | $64.000,00 | $800.000,00 | $85.600,00 | ||

| Year 2 | $550.000,00 | $44.880,00 | $550.000,00 | $59.895,00 | ||

| Year 1 | $350.000,00 | $29.680,00 | $350.000,00 | $39.795,00 | ||

| Total | $2.900.000,00 | $234.560,00 | $2.900.000,00 | $311.770,00 | ||

Choose your state

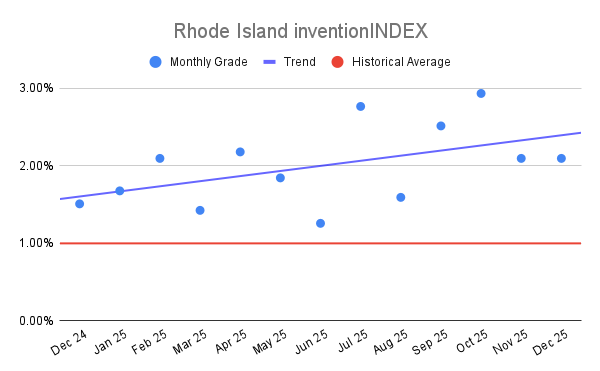

Rhode Island inventionINDEX December

Rhode Island inventionINDEX December  Rhode Island inventionINDEX

Rhode Island inventionINDEX