South Carolina R&D Tax Credit Filing Instructions

To claim the Research and Development (R&D) tax credit in South Carolina, businesses must first claim the federal R&D tax credit (pursuant to IRC § 41) for increasing research activities in the same taxable year. The South Carolina R&D credit is equal to 5% of the qualified research expenditures incurred within the state. This credit can be applied against corporate income tax and corporate license fees. It’s important to note that the credit claimed in any given tax year cannot exceed 50% of the company’s tax liability remaining after all other credits have been applied. Any unused portion of the credit can be carried forward for up to ten years. To make the claim, businesses must file SC Schedule TC-18, Research Expenses Credit, along with their annual South Carolina state tax return. This form requires details on South Carolina qualified research expenses, any credit carried forward from previous years, and the total credit before limitations.

South Carolina Patent of the Year – 2024/2025

Heatworks Technologies Inc. has been awarded the 2024/2025 Patent of the Year for revolutionizing fluid heating in household appliances. Their invention, detailed in U.S. Patent No. 12156624, titled ‘Dynamic fluid heater and washing appliance’, introduces a high-efficiency, compact heating system that rapidly warms water without traditional metal elements.

The patented system utilizes an intermediate liquid circulation path and a target fluid flow path, each thermally communicating via a heat exchanger. This design allows for precise, on-demand heating, making it ideal for portable dishwashers and other compact appliances. The system’s heater delivers at least 5 watts of heat per cubic centimeter, ensuring quick and consistent water temperatures.

Unlike conventional methods that rely on metal heating elements, Heatworks’ approach minimizes energy loss and reduces scaling issues. This innovation not only enhances appliance performance but also contributes to energy conservation and sustainability in everyday household tasks.

By integrating this advanced heating technology, Heatworks is setting new standards for efficiency and environmental responsibility in home appliances, paving the way for smarter, greener living solutions.

Study Case

Raceway Engineering (Raceway) is an automotive company that specializes in building engines for off-road speedway sprint cars.

To stay at the top of the market, Raceway is always conducting R&D work to assist in the creation of innovative ideas and products. Raceway decided it wanted to come up with a new modified version of its V8 super engine to use in its first futuristic car. The new engine would be based on the company’s previous engine, with updates and improvements.

Raceway launched an R&D project with the following hypothesis:

“The V8 super engine can be improved in terms of performance and fuel economy, while meeting safety regulations and outperforming competitors’ engines.”

Raceway needed to determine the eligibility of its proposed R&D activities in order to know if they qualified for the Research and Experimentation Tax Credit. To be eligible, Raceway had to be certain that its “qualified research” met four main criteria, known and developed by Congress as the Four-Part Test. After self-assessing, Raceway decided to register four R&D activities.

Design and development of a series of prototypes to achieve the technical objectives and prove the hypothesis (design of the modifications to the V8 super engine).

The hypothesis for this activity stated that it was feasible to design an improved and highly functioning V8 super engine that could outperform its competitors.

To try and prove the hypothesis, Raceway designed and redesigned multiple methods and engine parts during this phase.

Trials and analysis of data to achieve results that can be reproduced to a satisfactory standard (prototype development and testing of the V8 super engine).

Raceway’s hypothesis stated that the theoretical conclusions from the design phase could be realized through comprehensive and valid testing.

Raceway trialed the engine in a workshop environment and in the field to test for functionality, efficiency, accuracy and safety.

Background research to evaluate current knowledge gaps and determine feasibility (background research for the modification of the V8 engine).

Raceway conducted the following experiments during its research phase:- Literature search and review, including maintaining awareness of changing legislation in the different states and zones

- Consultation with industry professionals and potential customers to determine the level of interest and commercial feasibility of such a project

- Preliminary equipment and resources review with respect to capacity, performance and suitability for the project

- Consultation with key experts to determine the factors they considered important in the design, and to gain an understanding of how the design needed to be structured accordingly

Ongoing analysis of customer or user feedback to improve the prototype design (feedback R&D of the modifications of the V8 engine).

Raceway’s eligible R&D work during this phase of experimentation included:

- Ongoing analysis and testing to improve the efficiency and safety of the project.

- Ongoing development and modification to interpret the experimental results and draw conclusions that served as starting points for the development of new hypotheses.

- Commercial analysis and functionality review.

These activities were considered “qualified research” because they were necessary to evaluate the performance capabilities of the new design in the field and to improve any flaws in the design.

Qualified research consists of research for the intent of developing new or improved business components. A business component is defined as any product, process, technique, invention, formula, or computer software that the taxpayer intends to hold for sale, lease, license, or actual use in the taxpayer’s trade or business.

The Four-Part Test

Activities that are eligible for the R&D Credit are described in the “Four-Part Test” which must be met for the activity to qualify as R&D.

- Permitted Purpose: The purpose of the activity or project must be to create new (or improve existing) functionality, performance, reliability, or quality of a business component.

- Elimination of Uncertainty: The taxpayer must intend to discover information that would eliminate uncertainty concerning the development or improvement of the business component. Uncertainty exists if the information available to the taxpayer does not establish the capability of development or improvement, method of development or improvement, or the appropriateness of the business component’s design.

- Process of Experimentation: The taxpayer must undergo a systematic process designed to evaluate one or more alternatives to achieve a result where the capability or the method of achieving that result, or the appropriate design of that result, is uncertain at the beginning of the taxpayer’s research activities.

- Technological in Nature: The process of experimentation used to discover information must fundamentally rely on principles of hard science such as physical or biological sciences, chemistry, engineering or computer science.

What records and specific documentation did Raceway keep?

Similar to any tax credit or deduction, Raceway had to save business records that outlined what it did in its R&D activities, including experimental activities and documents to prove that the work took place in a systematic manner. Raceway saved the following documentation:

- Literature review

- Meeting notes

- Sketches/drawings

- Photos

- Screen shots

- Test protocols

- Test results and analysis

- Customer feedback

- Field-test results

By having these records on file, Raceway confirmed that it was “compliance ready” — meaning if it was audited by the IRS, it could present documentation to show the progression of its R&D work.

A manufacturing company in SC creating specialized parts for the automotive industries took a credit for the past two years when it designed a highly specialized prototype. This project involved a multi-year study covering the tax years 2013 and 2014.

The Company qualified for the federal R&D Tax Credits of $234,139 and an additional $127,120 in South Carolina state R&D Tax Credits.

| FEDERAL | SOUTH CAROLINA | |||||

| Year | Total QREs | Credit | Total QREs | Credit | ||

| 2026 | $1.485.300,00 | $137.687,00 | $1.485.300,00 | $66.838,00 | ||

| 2025 | $1.205.650,00 | $96.452,00 | $1.205.650,00 | $60.282,00 | ||

| Total | $2.690.950,00 | $234.139,00 | $2.690.950,00 | $127.120,00 | ||

Choose your state

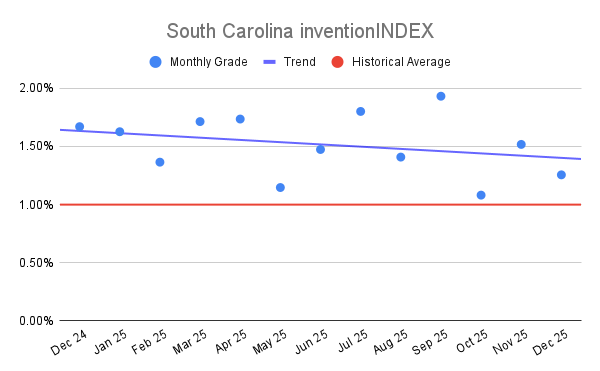

South Carolina inventionINDEX Dec

South Carolina inventionINDEX Dec  South Carolina invention

South Carolina invention