Virginia R&D Tax Credit Filing Instructions

To claim the Research and Development (R&D) tax credit in Virginia, businesses must first apply to the Virginia Department of Taxation by September 1st of the calendar year following the credit year. Virginia offers two main R&D credits: the Research and Development Expenses Tax Credit for those with qualified research expenses (QREs) of $5 million or less, and the Major Research and Development Expenses Tax Credit for those with QREs exceeding $5 million. The application for the former is made using Form RDC (Application for Research and Development Expenses Tax Credit), while the latter requires Form MRD (Application for Major Research and Development Expenses Tax Credit). Once the application is reviewed and approved by the Department of Taxation, a certification letter is issued. Businesses then claim the credit on their state income tax return by attaching the relevant schedule: individuals use Schedule CR, corporations use Form 500CR, and pass-through entities use Schedule 502 ADJ.

Virginia Patent of the Year – 2024/2025

Packet Forensics LLC has been awarded the 2024/2025 Patent of the Year for their innovative approach to network monitoring. Their invention, detailed in U.S. Patent No. 11863396, titled ‘Passive assessment of signal relays amongst bystanders’, introduces a novel method for discovering and assessing networks without prior configuration or alerting potential threats.

This groundbreaking technology enables a sensor to be installed within a network, where it can automatically determine the network address of a router and detect active clients. By emulating the network address of a client and utilizing the router’s address, the sensor can participate in network communications without disrupting existing traffic. This passive approach allows for real-time monitoring and data collection, essential for identifying vulnerabilities and ensuring network integrity.

One of the key advantages of this system is its non-intrusive nature. The sensor operates without requiring detailed network knowledge or configuration, making it accessible for deployment in various environments. Its ability to function without alerting potential adversaries is particularly valuable in sensitive or contested settings, where stealth and reliability are paramount.

Packet Forensics LLC’s invention marks a significant advancement in network security, offering a robust solution for continuous monitoring and assessment without compromising the operational integrity of the network.

Study Case

Carter Marine Group (CMG) specializes in marine infrastructure projects. In 2013, the company was approached by a client to create a permanent wharf in a high traffic import and export area.

CMG conducted R&D work to fulfill its client’s request with the main business objective being to design and develop a permanent wharf to assist in the importing and exporting of products in the oil and gas industry.

To qualify for the Research and Experimentation Tax Credit, CMG had to make sure its “qualified research” met four main criteria, known and developed by Congress as The Four-Part Test. After self-assessing, CMG declared the following experiments as R&D work.

Design and development of a series of prototypes to achieve the technical objectives (design of the permanent wharf).

The hypothesis for this activity stated that CMG could design a permanent wharf in a high traffic area to support imports/exports of the oil and gas industry.

After conducting theoretical design experiments, CMG concluded that such a design was feasible, but needed to be prototyped and fully tested to prove the hypothesis.

Trials and analysis of data to achieve results that can be reproduced to a satisfactory standard (prototype development and testing of the permanent wharf).

The hypothesis for this phase of the R&D experiment was that CMG could develop and test the wharf design to prove that it could be permanently installed to help the organization achieve its project objectives.

CMG concluded that the theoretical conclusions from the design phase could be realized through prototype development and related tests. CMG stated that the new knowledge generated would be used for further iterations of design and development and further field testing.

Background research to evaluate current knowledge gaps and determine feasibility (background research for permanent wharf).

CMG conducted the following R&D activities during this phase of its project:

- Literature search and review

- Initial discussions with marine engineers to discuss the feasibility of the project

- Review of existing drawings

- Consultation with industry professionals and potential customers to determine the level of interest and commercial feasibility of such a project

- Preliminary equipment and resources review with respect to capacity, performance and suitability for the project

- Consultation with key component/part/assembly suppliers to determine the factors they considered important in the design and to gain an understanding of how the design needed to be structured accordingly

The activities conducted during the background research were necessary because they assisted in identifying the key elements of the research project, therefore qualifying as R&D work.

Ongoing analysis of customer or user feedback to improve the prototype design (feedback R&D of the permanent wharf).

CMG’s eligible R&D activities for this phase of the project included:

- Ongoing analysis and testing to improve the efficiency and safety of the project.

- Ongoing development and modification to interpret the experimental results and draw conclusions that served as starting points for the development of new hypotheses.

- Commercial analysis and functionality review.

These activities were necessary to evaluate the performance capabilities of the new design in the field and to improve any flaws in the design.

Qualified research consists of research for the intent of developing new or improved business components. A business component is defined as any product, process, technique, invention, formula, or computer software that the taxpayer intends to hold for sale, lease, license, or actual use in the taxpayer’s trade or business.

The Four-Part Test

Activities that are eligible for the R&D Credit are described in the “Four-Part Test” which must be met for the activity to qualify as R&D.

- Permitted Purpose: The purpose of the activity or project must be to create new (or improve existing) functionality, performance, reliability, or quality of a business component.

- Elimination of Uncertainty: The taxpayer must intend to discover information that would eliminate uncertainty concerning the development or improvement of the business component. Uncertainty exists if the information available to the taxpayer does not establish the capability of development or improvement, method of development or improvement, or the appropriateness of the business component’s design.

- Process of Experimentation: The taxpayer must undergo a systematic process designed to evaluate one or more alternatives to achieve a result where the capability or the method of achieving that result, or the appropriate design of that result, is uncertain at the beginning of the taxpayer’s research activities.

- Technological in Nature: The process of experimentation used to discover information must fundamentally rely on principles of hard science such as physical or biological sciences, chemistry, engineering or computer science.

What records and specific documentation did CMG keep?

Similar to any tax credit or deduction, CMG had to save business records that outlined what it did in its R&D activities, including experimental activities and documents to prove that the work took place in a systematic manner.

CMG saved the following documentation:

- Literature review

- Project plans

- Photographs

- Progress reports

- Test results and analysis

- Customer feedback

- Field-test results

By having these records on file, CMG confirmed that it was “compliance ready” — meaning if it was audited by the IRS, it could present documentation to show the progression of its R&D work, ultimately proving its R&D eligibility.

A firm in Norfolk, Virginia designs components for the maritime industry. The company claims R&D credits each year for the design and development activities of its engineers. This project involved a multi-year study covering the tax years 2023 – 2026.

The Company qualified for the federal R&D Tax Credits of $204,435 and an additional $99,170 in Virginia state R&D Tax Credits.

| FEDERAL | VIRGINIA | |||||

| Year | Total QREs | Credit | Total QREs | Credit | ||

| 2026 | $950.000,00 | $88.635,00 | $950.000,00 | $44.460,00 | ||

| 2025 | $700.000,00 | $60.900,00 | $700.000,00 | $26.250,00 | ||

| 2024 | $450.000,00 | $37.800,00 | $450.000,00 | $18.900,00 | ||

| 2023 | $200.000,00 | $17.100,00 | $200.000,00 | $9.560,00 | ||

| Total | $2.300.000,00 | $204.435,00 | $2.300.000,00 | $99.170,00 | ||

Choose your state

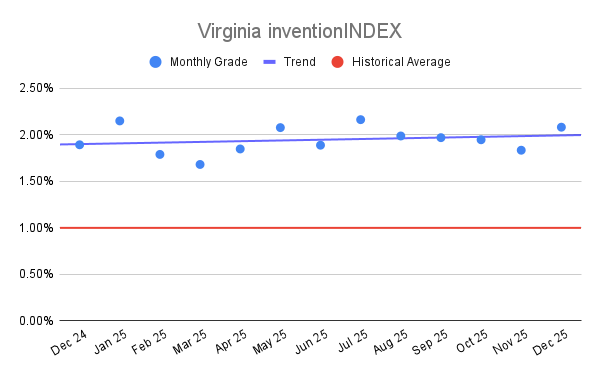

Virginia inventionINDEX December 2025:<

Virginia inventionINDEX December 2025:<  Virginia inventionINDEX Novemb

Virginia inventionINDEX Novemb