Alexandria, Virginia Patent of the Year – 2024/2025

RDW Advisors LLC. has been awarded the 2024/2025 Patent of the Year for its innovation in software platform architecture. Their invention, detailed in U.S. Patent No. 11907688, titled ‘System and method for a heterogeneous software platform’, introduces a unified framework that enables diverse software services to operate seamlessly together.

This system treats the entire software ecosystem as data, including definitions for the data types underpinning the framework, and stores all data transparently across a heterogeneous mix of data storage engines such as databases, files, and APIs. By using programming language-agnostic data types, the platform allows for dynamic manipulation and reloading of these types at runtime, facilitating adaptability and scalability.

The architecture supports key abstractions like environments, services, operations, and workflow management systems, all stored as data records. This design enables users to construct and modify complex workflows and services without extensive coding, streamlining development processes and reducing overhead.

RDW Advisors’ development represents a significant advancement in software engineering, offering a flexible and efficient solution for integrating and managing diverse software components within a cohesive system.

Choose your state

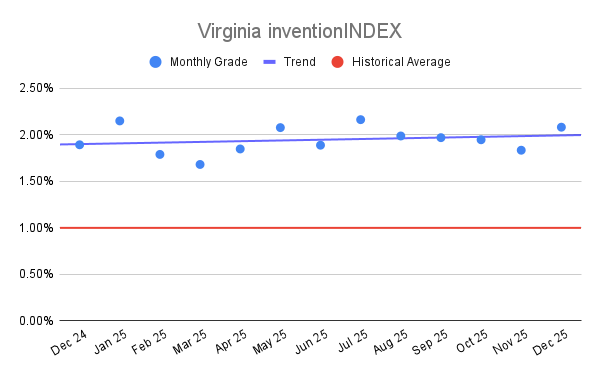

Virginia inventionINDEX December 2025:<

Virginia inventionINDEX December 2025:<  Virginia inventionINDEX Novemb

Virginia inventionINDEX Novemb