SOUTH DAKOTA INVENTIONINDEX | DECEMBER 2025

December 2025: 1.06% (A- grade)

South Dakota inventionINDEX December 2025: 1.06% (A- grade)

The inventionINDEX measures innovation output by comparing GDP growth with patent production growth.

Anything over C grade is positive sentiment; anything under C is negative outlook/sentiment. Using that sentiment, it is possible to observe trends over time, and also compare states/countries. In doing so, we can predict which states have the best chance to recover economically from the pandemic (or any other economic incident that may occur).

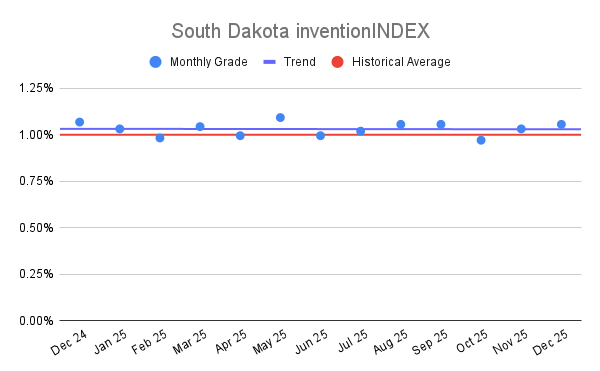

South Dakota inventionINDEX Scores – Last 12 months

| Month | inventionINDEX Score |

| December 2025 | 1.06% |

| Nov 25 | 1.03% |

| Oct 25 | 0.97% |

| Sep 25 | 1.06% |

| Aug 25 | 1.06% |

| Jul 25 | 1.02% |

| Jun 25 | 1.00% |

| May 25 | 1.09% |

| Apr 25 | 1.00% |

| Mar 25 | 1.04% |

| Feb 25 | 0.98% |

| Jan 25 | 1.03% |

| Dec 24 | 1.07% |

The South Dakota inventionINDEX concludes the year 2025 on a robust trajectory, reaching a score of 1.06% and an A- rating in December. This represents a measured recovery from the volatility observed in the middle of the fourth quarter, specifically the dip to 0.97% in October. By returning to the 1.06% level seen during the late summer months of August and September, the index demonstrates a resilient trend in regional innovation. This steady stabilization through the final month of the year suggests a strengthening of the state’s intellectual property landscape as it prepares for the upcoming fiscal cycle.

When viewed against the broader sixty-month historical backdrop, the current score of 1.06% reflects a healthy position that remains consistent with the state’s long-term performance averages. While the index is currently lower than the historical peak of 1.20% recorded in February 2021, it remains significantly improved from the five-year low of 0.96% experienced in February 2023. The historical data indicates that the index frequently fluctuates within the 1.02% to 1.09% range, suggesting that the current performance is well within the upper quartile of typical activity. Maintaining a score above the 1.00% threshold has historically served as a benchmark for sustained creative output within the state, placing the December 2025 performance in a favorable historical context.

Higher grades within the inventionINDEX, such as the current A- or the coveted A+ ratings seen periodically over the last five years, signal a vibrant environment for research and development. An elevated score often correlates with increased patent filings, higher levels of venture capital investment, and a more competitive workforce. These positive outcomes foster an ecosystem where local entrepreneurs can thrive and established industries can modernize through technological advancement. Furthermore, a consistent A-level rating enhances the state’s reputation as a hub for ingenuity, which can attract outside talent and business relocations that further stimulate the local economy and diversify its industrial base.

Conversely, a decline in the index toward the D or C ranges presents several negative implications for the state’s economic vitality. Lower scores typically indicate a stagnation in the creative pipeline, which can lead to a loss of competitive advantage relative to neighboring regions and global markets. Such downturns may discourage institutional investment and result in a reduction of high-value job opportunities, potentially leading to a migration of talent to more innovative locales. If the score remains suppressed over an extended period, it could signal systemic barriers to innovation, such as a lack of infrastructure for emerging technologies or reduced funding for academic research, necessitating strategic policy adjustments to restore the state’s creative momentum.

Discussion:

In December, the South Dakota inventionINDEX scored a positive sentiment which was higher than the previous year’s average and outperformed the upward trend for the year. This is in contrast to the prior 12 months, which experienced a slight downward trend.

As the economy continues to stabilize in the post-pandemic era, it remains uncertain whether any backlog of applications still exists or if the department has returned to normal processing timelines. The inventionINDEX could also be affected by lingering consequences from the pandemic, such as company closures, reduced workforces, and limited R&D capabilities, which may still be impacting current operations.

Learn More:

Are you thinking of patenting any of your bright ideas? Did you know your research work could be eligible for the R&D Tax Credit and you can receive up to 14% back on your expenses? To find out more, please check out our free online eligibility test.

Swanson Reed’s South Dakota office provides R&D tax credit consulting and advisory services to Sioux Falls, Rapid City, Aberdeen, Brookings, and Watertown.

Feel free to book a quick teleconference with one of R&D tax specialists if you would like to learn more about R&D tax credit opportunities.

Who We Are:

Swanson Reed is the largest Specialist R&D tax credit advisory firm in the United States. With offices nationwide, we are one of the only firms globally to exclusively provide R&D tax credit consulting services to our clients. We have been exclusively providing R&D tax credit claim preparation and audit compliance solutions for over 30 years.

Swanson Reed hosts daily free webinars and provides free IRS CE and CPE credits for CPAs. For more information please visit us at www.swansonreed.com/free-webinars or contact your usual Swanson Reed representative.

What is the R&D Tax Credit?

The Research & Experimentation Tax Credit (or R&D Tax Credit), is a general business tax credit under Internal Revenue Code section 41 for companies that incur research and development (R&D) costs in the United States. The credits are a tax incentive for performing qualified research in the United States, resulting in a credit to a tax return. For the first three years of R&D claims, 6% of the total qualified research expenses (QRE) form the gross credit. In the 4th year of claims and beyond, a base amount is calculated, and an adjusted expense line is multiplied times 14%. Click here to learn more.

R&D Tax Credit Preparation Services

Swanson Reed is one of the only companies in the United States to exclusively focus on R&D tax credit preparation. Swanson Reed provides state and federal R&D tax credit preparation and audit services to all 50 states.

If you have any questions or need further assistance, please call or email our CEO, Damian Smyth on (800) 986-4725.

Feel free to book a quick teleconference with one of our national R&D tax credit specialists at a time that is convenient for you.

R&D Tax Credit Audit Advisory Services

creditARMOR is a sophisticated R&D tax credit insurance and AI-driven risk management platform. It mitigates audit exposure by covering defense expenses, including CPA, tax attorney, and specialist consultant fees—delivering robust, compliant support for R&D credit claims. Click here for more information about R&D tax credit management and implementation.

Our Fees

Swanson Reed offers R&D tax credit preparation and audit services at our hourly rates of between $195 – $395 per hour. We are also able offer fixed fees and success fees in special circumstances. Learn more at https://www.swansonreed.com/about-us/research-tax-credit-consulting/our-fees/

Choose your state