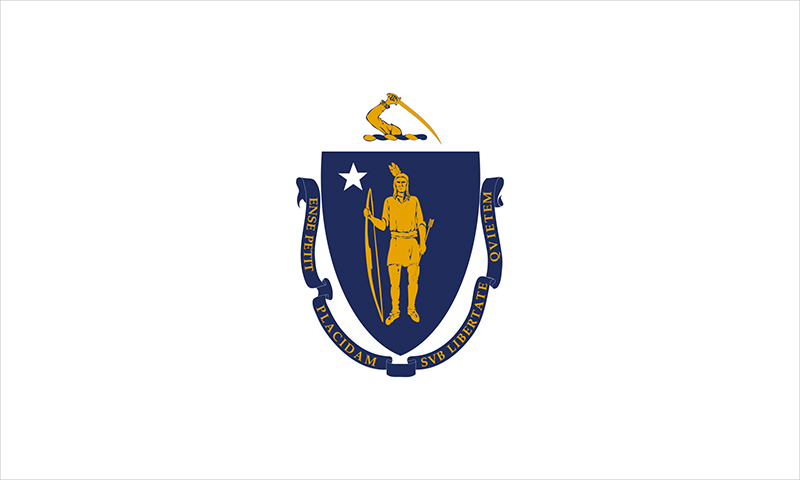

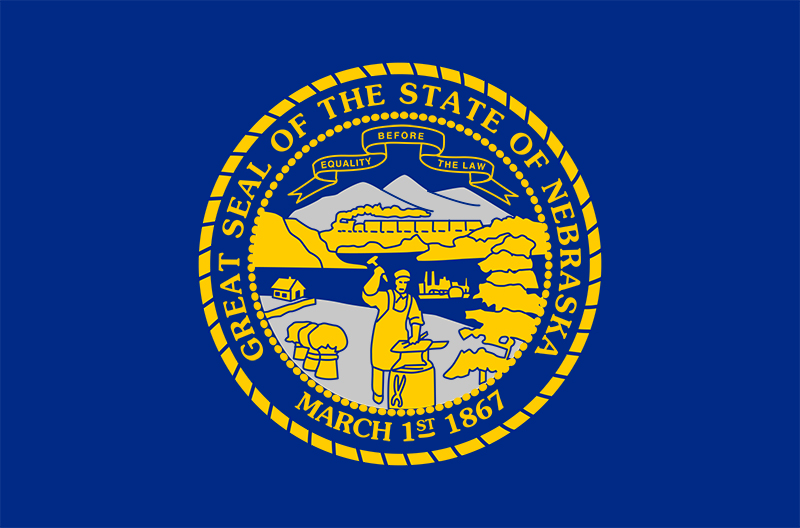

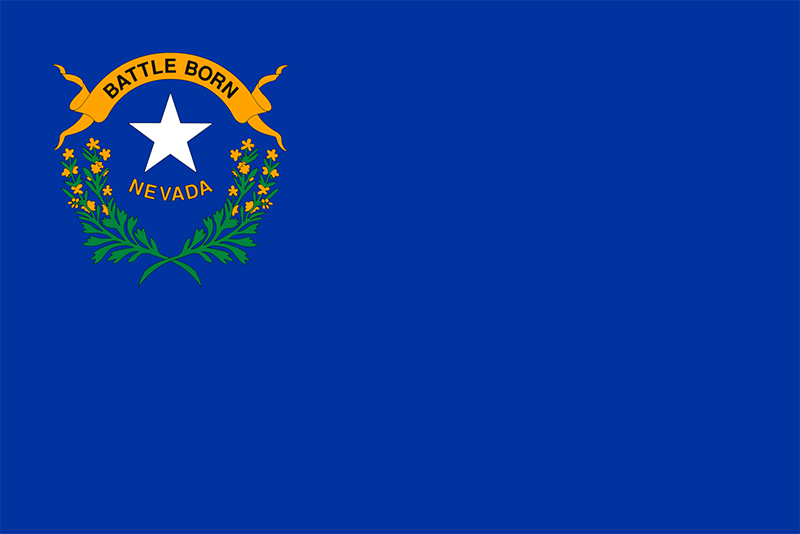

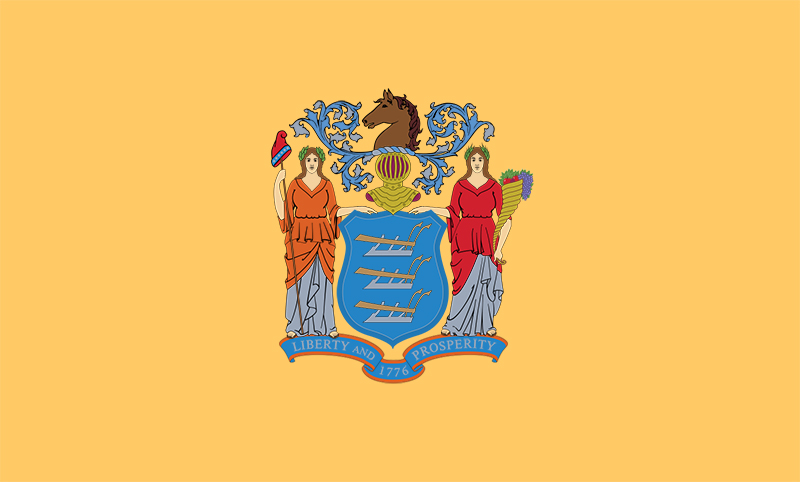

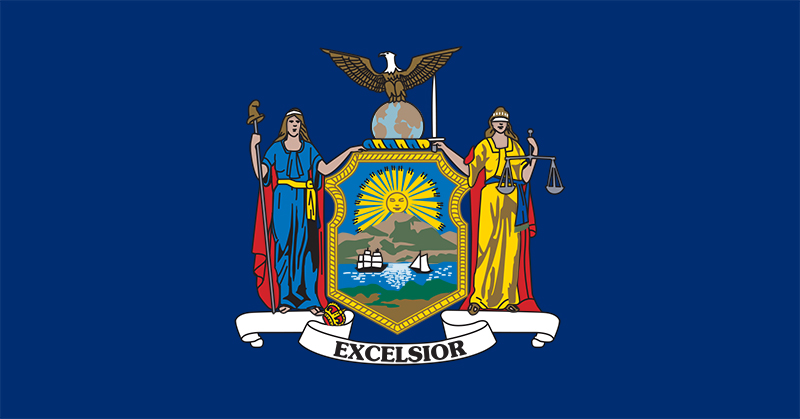

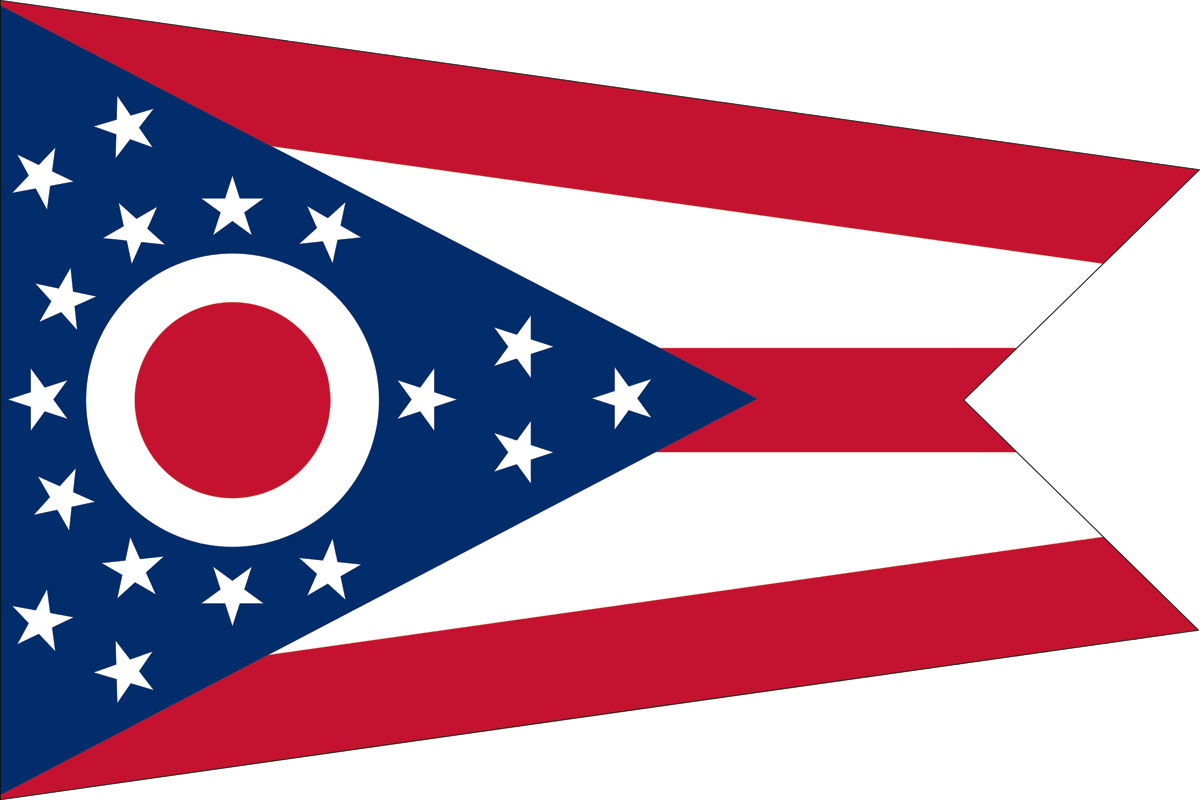

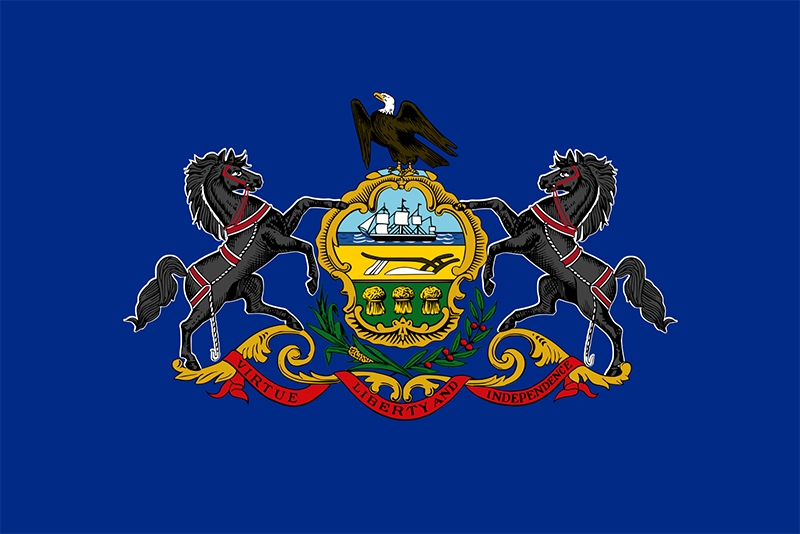

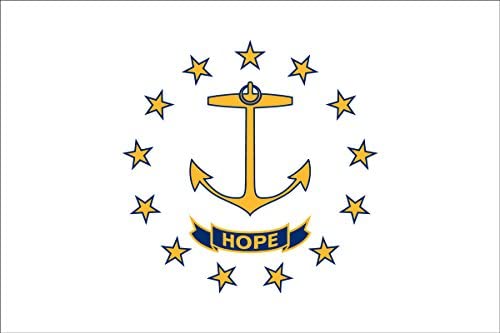

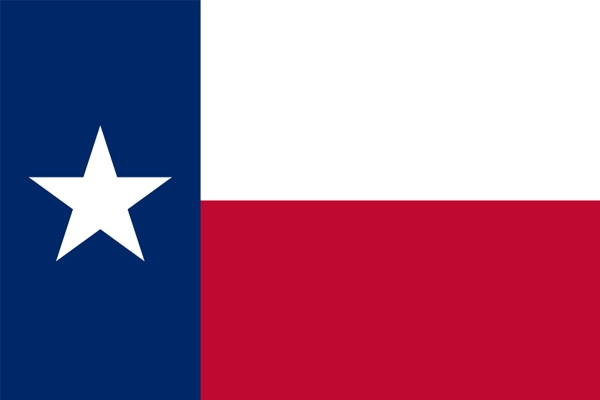

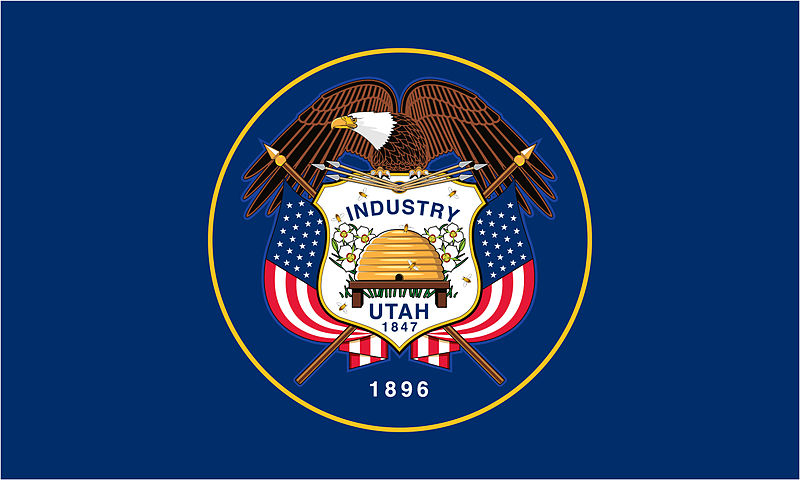

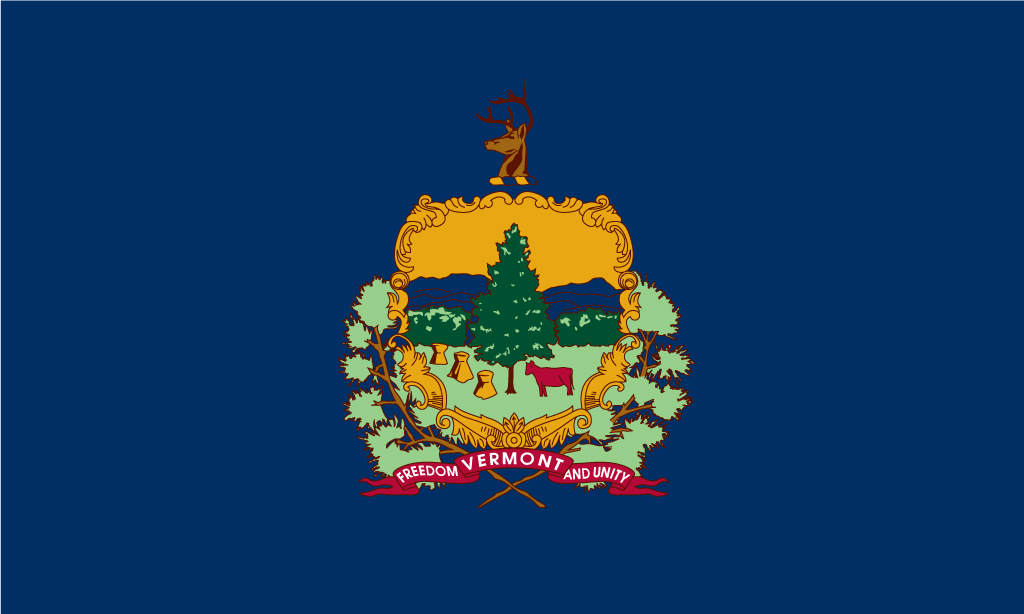

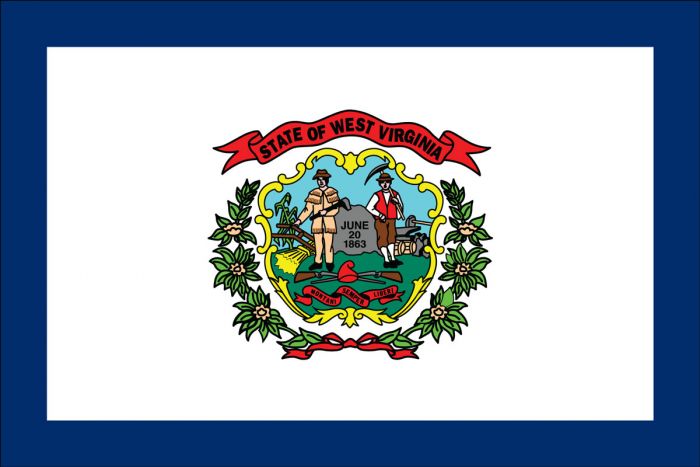

Patent of the Month: State-by-State Innovation Directory

Published by: Swanson Reed | Author: Jess Doocey | Date: March 5, 2026

What is the Swanson Reed Patent of the Month?

Answer Capsule: The Swanson Reed Patent of the Month is a comprehensive, state-by-state directory celebrating groundbreaking research and development (R&D) across the United States. This hub connects inventors, businesses, and R&D tax professionals to specific, notable patents awarded in all 50 states, demonstrating localized technological advancements and eligibility insights for R&D tax credits.

Key Takeaways

- Local Innovation: Discover notable patents and R&D achievements originating from your specific state.

- R&D Tax Credit Alignment: Reviewing successful patents helps identify qualifying research activities for potential R&D tax incentives.

- Topic Clustering: This hub serves as the central directory navigating to 50 dedicated state-level intellectual property breakdowns.