Tennessee Patent of the Year – 2024/2025

S2 Cognition Inc. has been awarded the 2024/2025 Patent of the Year for revolutionizing cognitive performance assessment. Their invention, detailed in U.S. Patent No. 12029479, titled ‘Methods and apparatus to measure fast-paced performance of people’, introduces a dynamic evaluation system that quantifies how individuals process information and make decisions in high-pressure, visually complex environments.

Unlike traditional cognitive tests, S2 Cognition’s patented system immerses users in interactive tasks designed to simulate real-world challenges. These tasks assess key cognitive skills such as visual perception, memory, learning, and command and control. For instance, users might be asked to track multiple moving targets or respond to rapidly changing stimuli, measuring their ability to react swiftly and accurately under pressure.

This technology has significant implications across various fields. In sports, it can help tailor training programs to enhance athletes’ in-game decision-making. In military and defense sectors, it offers a tool to evaluate personnel’s cognitive readiness in dynamic scenarios. Additionally, the system aids in monitoring recovery from concussions by assessing cognitive function over time.

By providing a comprehensive analysis of cognitive performance, S2 Cognition’s innovative approach sets a new standard for evaluating human capabilities in fast-paced environments, paving the way for more effective training and assessment methodologies.

Study Case

Earhart Engineering is a widely renowned engineering company specializing in modern building of transportation methods, systems and equipment.

Dedicated to being one step ahead of its competitors, Earhart Engineering proposed an R&D plan to create the ‘Self-e,’ an electric, self-operating vehicle/aircraft. Earhart’s main objective was to develop a legal transportation vehicle/aircraft using battery technology that would allow it to travel up to 500 miles without requiring a recharge, while being completely machine operated.

To qualify for the Research and Experimentation Tax Credit, Earhart Engineering had to make sure its “qualified research” met four main criteria, known and developed by Congress as The Four-Part Test. After self-assessing, Earhart Engineering declared the following experiments as R&D work.

Design and development of a series of prototypes to achieve the technical objectives (design of the Self-e vehicle/aircraft).

The hypothesis for this R&D activity was that designing, testing and evaluating various concepts would contribute to a more efficient and effective prototype testing phase.

After two years of design and experimentation, Earhart Engineering concluded that its theoretical design experiments showed that such designs were feasible but needed to be prototyped and fully tested to prove the hypothesis.

Trials and analysis of data to achieve results that can be reproduced to a satisfactory standard and to test the hypothesis (prototype development and testing of the Self-e vehicle/aircraft).

Earhart Engineering’s hypothesis for this experiment was that developing and implementing the various design components would allow refinement and tweaking of the final product to achieve the technical objectives.

After two years of trial and error, Earhart Engineering had created a vehicle capable of performing the main functions of the ‘Self-e’ but was below the company’s expectations overall. Earhart Engineering concluded that it was on the right track, and that it would continue to work on improving its design until it met its targeted performance criteria.

Background research to evaluate current knowledge gaps and determine feasibility (background research for the design of the Self-e).

Earhart Engineering engaged in background research for two years which included activities such as literature search and review, consultation with industry professionals and potential customers, and preliminary equipment and resources review with respect to capacity, performance and suitability for the project.

These specific background research activities qualified as R&D because they assisted in identifying the key elements of the research project.

Ongoing analysis of customer or user feedback to improve the prototype design (feedback R&D of the Self-e).

Feedback research and development work for the Self-e included ongoing analysis and testing to improve the efficiency and safety of the project, continuous development and modification, and commercial analysis and functionality of review.

Earhart Engineering believed these activities were necessary to evaluate the performance capabilities of the new design in the field and to improve any flaws in the design, therefore qualifying as R&D.

Qualified research consists of research for the intent of developing new or improved business components. A business component is defined as any product, process, technique, invention, formula, or computer software that the taxpayer intends to hold for sale, lease, license, or actual use in the taxpayer’s trade or business.

The Four-Part Test

Activities that are eligible for the R&D Credit are described in the “Four-Part Test” which must be met for the activity to qualify as R&D.

- Permitted Purpose: The purpose of the activity or project must be to create new (or improve existing) functionality, performance, reliability, or quality of a business component.

- Elimination of Uncertainty: The taxpayer must intend to discover information that would eliminate uncertainty concerning the development or improvement of the business component. Uncertainty exists if the information available to the taxpayer does not establish the capability of development or improvement, method of development or improvement, or the appropriateness of the business component’s design.

- Process of Experimentation: The taxpayer must undergo a systematic process designed to evaluate one or more alternatives to achieve a result where the capability or the method of achieving that result, or the appropriate design of that result, is uncertain at the beginning of the taxpayer’s research activities.

- Technological in Nature: The process of experimentation used to discover information must fundamentally rely on principles of hard science such as physical or biological sciences, chemistry, engineering or computer science.

What records and specific documentation did Earhart Engineering keep?

Similar to any tax credit or deduction, Earhart Engineering had to save business records that outlined what it did in its R&D activities, including experimental activities and documents to prove that the work took place in a systematic manner. Earhart Engineering saved the following documentation:

- Literature review

- Background research

- Meeting notes or minutes or progress reports

- Project records / laboratory notes

- Conceptual sketches

- Design drawings

- Photographs / videos of various parts or components

By having these records on file, Earhart Engineering confirmed that it was “compliance ready” — meaning if it was audited by the IRS, it could present documentation that illustrated the progression of its R&D activity, ultimately proving its R&D eligibility.

Choose your state

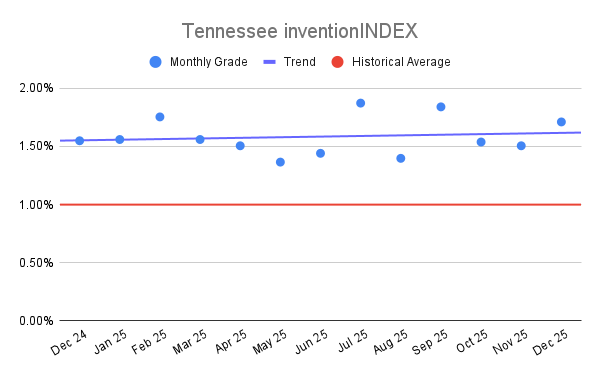

Tennessee inventionINDEX December 2025

Tennessee inventionINDEX December 2025  Tennessee inventionINDEX Nove

Tennessee inventionINDEX Nove