Washington Patent of the Year – 2024/2025

Clearbrief Inc. has been awarded the 2024/2025 Patent of the Year for transforming legal citation workflows. Their invention, detailed in U.S. Patent No. 12141211, titled ‘System, method, and computer program product for tokenizing document citations’, automates the extraction and structuring of citations within legal documents.

Clearbrief’s patented technology revolutionizes how legal professionals handle citations. By tokenizing citation elements – such as case names, court identifiers, and dates – the system creates standardized tokens that can be grouped and analyzed. This process ensures consistent citation formatting and enhances the accuracy of legal documents.

Beyond mere formatting, the system assigns metadata to each citation token, enabling dynamic updates and corrections. This feature is particularly valuable in legal environments where precision and compliance with citation standards are paramount.

Clearbrief’s innovation addresses a critical need in legal documentation. By streamlining the citation process, the technology reduces manual errors and accelerates document preparation. This advancement not only improves efficiency but also supports the integrity of legal writing, ensuring that citations are both accurate and appropriately formatted.

As legal practices increasingly adopt digital tools, Clearbrief’s solution stands out as a significant step forward in integrating technology with legal workflows. This patent underscores Clearbrief’s commitment to enhancing legal practices through innovation and precision.

Study Case

Jungle Junction is a popular, high-quality zoo that offers the viewing of and interaction with animals that are native to the jungle.

In 2008, Jungle Junction noticed an increase in the number of deaths in its gorilla population. After further research, Jungle Junction discovered that the majority of deaths were caused by infectious diseases.

After establishing that infectious diseases were a major cause of mortality in captive gorillas, Jungle Junction began an R&D project aimed at controlling and preventing the situation. The company’s main business objective was to create a medical device that could detect disease in gorillas in its early stages which would lead to improvements in diagnosis and management of disease in gorilla populations.

To achieve its technical objectives and overcome the related technical risks, Jungle Junction generated new knowledge at the conclusion of each experimental stage and built upon this knowledge at every stage of the project. To qualify for the Research and Experimentation Tax Credit, Jungle Junction had to make sure its “qualified research” met four main criteria, known and developed by Congress as The Four-Part Test. After self-assessing, Jungle Junction declared the following experiments as R&D work.

Design and development of a series of prototypes to achieve the technical objectives and prove the hypothesis (design and adaptation of the disease detection device).

Jungle Junction’s hypothesis for its experiment stated that a disease detection device for gorillas could be designed and developed.

After two years of design and experimentation, Jungle Junction concluded that its experiments showed that such designs were feasible but needed to be fully tested to prove the hypothesis.

Trials and analysis of data to achieve results that can be reproduced to a satisfactory standard (development and testing of the disease detection device).

The hypothesis for this R&D activity stated that with improved knowledge of the specific infectious diseases and their carriers, it was possible to identify mechanisms for improving disease detection in gorilla populations.

Details of this experiment included development of the device based on information gained through the model and testing of the device to ensure efficiency, accuracy and safety.

Background research to evaluate current knowledge gaps and determine feasibility (background research for the design of the disease detection device).

Jungle Junction engaged in background research that included the following activities:

- Literature search and review

- Consultation with industry professionals and potential customers to determine the level of interest and commercial feasibility of such a project

- Preliminary equipment and resources review with respect to capacity, performance and suitability for the project

The activities conducted in the background research were necessary because they assisted in identifying the key elements of the research project, therefore qualifying as R&D work.

Ongoing analysis of customer or user feedback to improve the prototype design (feedback R&D of the disease detection device).

Jungle Junction’s eligible R&D activities during this phase of the project included:

- Ongoing analysis and testing to improve the efficiency and safety of the project.

- Ongoing development and modification to interpret the experimental results and draw conclusions that served as starting points for the development of new hypotheses.

- Commercial analysis and functionality review.

These activities qualified as R&D work because they were necessary to evaluate the performance capabilities of the new design in the field and to improve any flaws in the design.

Qualified research consists of research for the intent of developing new or improved business components. A business component is defined as any product, process, technique, invention, formula, or computer software that the taxpayer intends to hold for sale, lease, license, or actual use in the taxpayer’s trade or business.

The Four-Part Test

Activities that are eligible for the R&D Credit are described in the “Four-Part Test” which must be met for the activity to qualify as R&D.

- Permitted Purpose: The purpose of the activity or project must be to create new (or improve existing) functionality, performance, reliability, or quality of a business component.

- Elimination of Uncertainty: The taxpayer must intend to discover information that would eliminate uncertainty concerning the development or improvement of the business component. Uncertainty exists if the information available to the taxpayer does not establish the capability of development or improvement, method of development or improvement, or the appropriateness of the business component’s design.

- Process of Experimentation: The taxpayer must undergo a systematic process designed to evaluate one or more alternatives to achieve a result where the capability or the method of achieving that result, or the appropriate design of that result, is uncertain at the beginning of the taxpayer’s research activities.

- Technological in Nature: The process of experimentation used to discover information must fundamentally rely on principles of hard science such as physical or biological sciences, chemistry, engineering or computer science.

What records and specific documentation did Jungle Junction keep?

Similar to any tax credit or deduction, Jungle Junction had to save documents that outlined what it did in its R&D activities, including experimental activities and business records to prove that the work took place in a systematic manner.

Jungle Junction saved the following documentation:

- Literature review

- Background research

- Project records and laboratory notebooks

- Testing protocols

- Results or analysis from testing / trial runs

- Progress reports and meeting minutes

- Records of resource allocation / usage logs

- Staff time sheets

By having these records on file, Jungle Junction confirmed that it was “compliance ready” — meaning if it was audited by the IRS, it could present documentation to show the progression of its R&D activity, ultimately proving its R&D eligibility.

Choose your state

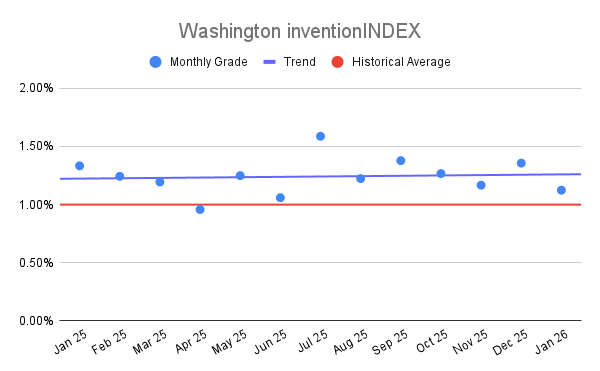

Washington inventionINDEX January 20

Washington inventionINDEX January 20