Florida R&D Tax Credit Filing Instructions

To claim the Research and Development (R&D) tax credit in Florida, eligible businesses, primarily C corporations in specific target industries (such as manufacturing, life sciences, and technology), must first secure a certification letter from the Florida Department of Commerce (FloridaCommerce) confirming their status as a qualified target industry business. This certification is generally valid for up to three years. Once certified, businesses can apply for an allocation of the R&D tax credit with the Florida Department of Revenue (DOR) by filing Form F-1196, Allocation for Research and Development Tax Credit for Florida Corporate Income/Franchise Tax. Applications are typically accepted online between March 20 and March 26 each year for qualified research expenses incurred in the prior calendar year. It’s crucial to note that there’s an annual statewide cap on the total amount of credits awarded, which are distributed on a first-come, first-served basis. Businesses must also have claimed the federal R&D tax credit under IRC Section 41 for the same tax year to be eligible for the Florida credit.

Florida Patent of the Year – 2024/2025

Smart Technology Device Integration LLC has been awarded the 2024/2025 Patent of the Year for their innovative approach to integrating smart technology into everyday fabrics. Their invention, detailed in U.S. Patent No. 11880730, titled ‘Radio-frequency communication-enabled fabrics and related methods’, introduces a novel method for embedding Near Field Communication (NFC) technology into textiles.

This groundbreaking technology allows garments and other fabric items to communicate directly with electronic devices. By embedding an NFC-enabled RFID tag between waterproof layers and affixing it securely to the fabric, the system enables users to access information or perform actions simply by bringing their device close to the fabric. This could mean automatic access to product details, promotional content, or even direct interactions with apps and services.

The process involves heat-sealing the NFC tag between durable, water-resistant layers, ensuring the tag remains intact through repeated wear and washing. This robust construction makes the technology suitable for a wide range of applications, from retail and fashion to healthcare and logistics.

Smart Technology Device Integration LLC’s innovation marks a significant step forward in the field of wearable technology, offering a seamless blend of functionality and convenience. As the world becomes increasingly connected, this advancement paves the way for a new era of interactive, smart textiles.

Study Case

Airtime Helicopters (Airtime) was established in 2008 to provide charter, scenic and photography services.

Airtime felt a need to further enhance the recording quality and stability of its current camera unit to improve clarity and visibility during vertical monochromatic imaging, mapping and surveying. In 2009, Airtime began an R&D project dedicated to developing and designing an attachment camera which would provide helicopter camera crews with unprecedented levels of equipment reliability for use in mapping and imaging applications.

Airtime engaged in a program of systematic, investigative and experimental activities to overcome the significant technical uncertainty and develop new knowledge regarding the impact of specific variables on the effectiveness of the new attachment design.

After experimentation, Airtime needed to determine the eligibility of its proposed R&D activities in order to know if they qualified for the Research and Experimentation Tax Credit. To be eligible, Airtime had to be certain that its “qualified research” met four main criteria, known and developed by Congress as the Four-Part Test. After self-assessing, Airtime conducted the following R&D activities.

Design and development of a series of prototypes to achieve the technical objectives and prove the hypothesis (design and development of a camera for mapping and surveying purposes).

Airtime conducted the design and development of spring settings on specific camera types, as well as design consideration on the impact of different wind conditions. Airtime believed its camera solution could be achieved by conducting the following activities to reduce the unit’s vibration:

A series of information was gathered and evaluated to identify knowledge gaps and achieve the technical objectives.

A series of design experiments were undertaken to prove the hypothesis.

A series of trial data was analyzed and evaluated to achieve satisfactory reproducible results.

A series of developments and modifications were undertaken to interpret the algorithm data and draw conclusions that served as a starting point for the new design hypothesis.

Background research to evaluate current knowledge gaps and determine feasibility (background research for mapping and surveying camera unit).

The following background research was conducted by Airtime:

Literature search and review

Consultation with industry professionals and potential clients to determine the level of interest and commercial feasibility of such a project

Preliminary equipment and resources review with respect to capacity, performance and suitability for the project

Airtime’s background research qualified as R&D because it assisted in identifying the key elements of the project.

Ongoing analysis of customer or user feedback to improve the prototype design (feedback R&D of the camera and its mapping and surveying abilities).

Airtime conducted the following R&D activities during this phase of experimentation:

Ongoing analysis and testing to improve the efficiency of the project

Commercial analysis and functionality review

These activities qualified as R&D because they were necessary to evaluate the performance capabilities of the newly developed design in the field and to improve any imperfections.

Qualified research consists of research for the intent of developing new or improved business components. A business component is defined as any product, process, technique, invention, formula, or computer software that the taxpayer intends to hold for sale, lease, license, or actual use in the taxpayer’s trade or business.

The Four-Part Test

Activities that are eligible for the R&D Credit are described in the “Four-Part Test” which must be met for the activity to qualify as R&D.

- Permitted Purpose: The purpose of the activity or project must be to create new (or improve existing) functionality, performance, reliability, or quality of a business component.

- Elimination of Uncertainty: The taxpayer must intend to discover information that would eliminate uncertainty concerning the development or improvement of the business component. Uncertainty exists if the information available to the taxpayer does not establish the capability of development or improvement, method of development or improvement, or the appropriateness of the business component’s design.

- Process of Experimentation: The taxpayer must undergo a systematic process designed to evaluate one or more alternatives to achieve a result where the capability or the method of achieving that result, or the appropriate design of that result, is uncertain at the beginning of the taxpayer’s research activities.

- Technological in Nature: The process of experimentation used to discover information must fundamentally rely on principles of hard science such as physical or biological sciences, chemistry, engineering or computer science.

What records and specific documentation did Wino keep?

Similar to any tax credit or deduction, Wino had to save business records that outlined what it did in its R&D activities, including experimental activities and documents to prove that the work took place in a systematic manner.

Wino saved the following documentation:

- Progress of project (e.g. meeting notes, minutes, emails, reports)

- Conceptual sketches and technical drawings

- Photographs of completed models

- Testing protocols

- Results or records of analysis from testing / trial runs

- Tax invoices

By having these records on file, Wino confirmed that it was “compliance ready” — meaning if it was audited by the IRS, it could present documentation to show the progression of its R&D work, ultimately proving its R&D eligibility.

An Orlando company designs and develops component parts for the aviation industry, a qualified target business industry for Florida’s R&D tax credit. The Company started R&D in 2017 and claims R&D credits each year for the development activities of its engineers. The company submits its application and is awarded an R&D credit for the 2021 tax year. Prior year Florida QREs for 2022, 2023, 2024, and 2025 are as follows: $500,000, $600,000, $700,000, and $800,000, respectively. The Federal credit calculated below is utilizing the Alternative Simplified Method.

| FEDERAL | FLORIDA | |||||

| Year | Total QREs | Credit | Total QREs | Credit | ||

| 2026 | $1.200.000,00 | $100.800,00 | $1.200.000,00 | $30.000,00 | ||

Choose your state

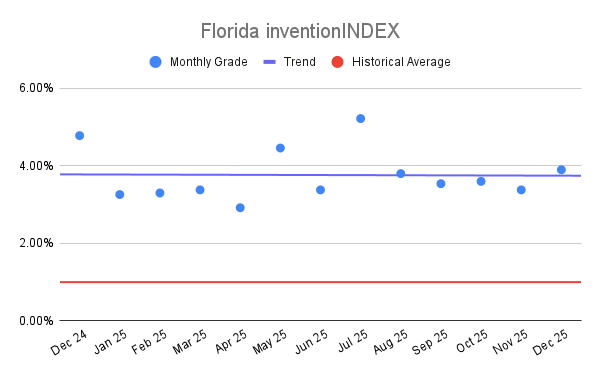

Florida inventionINDEX December 2025:[...]

Florida inventionINDEX December 2025:[...] Florida inventionINDEX November

Florida inventionINDEX November