New Hampshire R&D Tax Credit Filing Instructions

To claim the Research and Development (R&D) tax credit in New Hampshire, eligible businesses must file Form DP-165, “Research & Development Tax Credit Application,” with the New Hampshire Department of Revenue Administration. This application must be submitted by June 30 following the close of the taxable year in which the R&D occurred. Along with Form DP-165, a copy of the business’s Federal Form 6765, “Credit for Increasing Research Activities,” must also be attached. The New Hampshire R&D tax credit is primarily for qualified manufacturing research and development expenditures incurred within the state, typically defined as wages that qualify under Section 41 of the Internal Revenue Code. The credit amount is generally the lesser of 10% of the excess qualified R&D expenses over a base amount, or $50,000 per fiscal year. Once awarded, the credit is first applied against the business’s Business Profits Tax liability, with any remaining amount able to be applied against the Business Enterprise Tax liability. Unused credits can be carried forward for five subsequent tax years.

New Hampshire Patent of the Year – 2024/2025

A5G Networks Inc. has been awarded the 2024/2025 Patent of the Year for their innovative approach to autonomous network connectivity. Their invention, detailed in U.S. Patent No. 11909833, titled ‘Multi-cloud connectivity software fabric for autonomous networks’, introduces a novel method for integrating distributed, hybrid, and multi-cloud infrastructures to create a unified communication network.

This patented system utilizes artificial intelligence (AI) and machine learning (ML) to autonomously manage and optimize network functions across various cloud environments. By employing a layered architecture – comprising discovery, control, and data layers – the system intelligently allocates resources, authenticates clients, and directs data traffic based on real-time demands and historical usage patterns. This dynamic adaptability ensures efficient and secure connectivity, even as network conditions and requirements evolve.

A key feature of this innovation is its ability to federate authentication processes across multiple networks, reducing latency and enhancing security. The system’s design supports seamless integration between public operator networks and private enterprise networks, facilitating a ‘network of networks’ that maintains unified compute resources despite underlying heterogeneity.

A5G Networks’ advancement represents a significant leap forward in the evolution of self-driving, AI-powered networks. By enabling intelligent edge services and smart in-line functionalities, this technology lays the groundwork for next-generation connectivity solutions in sectors such as smart cities, connected vehicles, and industrial automation.

Study Case

Hunter Engineering is a family run business that is dedicated to producing custom, environmentally-friendly hunting products with the use of professional machinery.

With lead fishing sinkers banned in the United Kingdom, Canada and various U.S. states due to the environmental concerns surrounding them, Hunter Engineering instigated a project with the main business objective being to design and develop an alternate and improved copper fishing sinker.

The key areas of investigation and experimentation due to specific technical objectives for Hunter Engineering were the following:

- Because copper is a much lighter metal than lead, a copper sinker must be shaped differently to enable it to sink properly and be cast over a distance.

- Because copper erodes much easier than lead, the development of a coating was required.

After experimentation, Hunter Engineering had to determine which of its project activities qualified for the Research and Experimentation Tax Credit. To be eligible, Hunter Engineering had to be sure that its “qualified research” met four main criteria, known and developed by Congress as the Four-Part Test. Hunter Engineering decided that development of an efficient copper sinker was indeed possible with the conduction of four R&D activities.

Design and development of a series of prototypes to achieve the technical objectives (design of the copper sinker).

The hypothesis for this activity questioned whether a lead-free, copper fishing sinker could be designed and developed to outperform existing lead fishing weights.

Hunter Engineering created a 3D model of the copper sinker in order to accurately predict the weight and then sent it to an industry professional for recalculation. Based on the recalculations, the experts at Hunter Engineering developed the design for the sinker.

Hunter Engineering concluded that a small increase in the diameter of the fishing weight produced a significant improvement in the sinking and flying characteristics.

Trials and Analysis of data to achieve results that can be reproduced to a satisfactory standard, and to test the hypothesis (testing of various coatings and methods to apply the lubricant onto the sinker).

The hypothesis for this activity was to investigate an optimum coating (or lubricant) that could be applied to the copper sinker to prevent it from eroding in water.

Each type of lubricant was tested on a round of fifteen sinkers over a year. Hunter Engineering tried numerous off-the-shelf products by mixing them with other types of lubricants. However, they ended up developing a binder to help the lubricant stay on the copper sinker.

Hunter Engineering did find a successful coating that had to be mixed with the binder and then sprayed on the sinker before use.

Background research to evaluate current knowledge gaps and determine feasibility (background research for the design of the copper sinker).

Hunter Engineering conducted the following background research:

- Review of final computer-generated calculations for potential specifications for the design of the copper sinker

- Analysis of available competitors’ products and components

- Preliminary equipment and resources review with respect to capacity, performance and suitability for the project

- Consultation with key component/part/assembly suppliers to determine the factors they considered important in the design and to gain an understanding of how the design needed to be structured accordingly

These specific background research activities assisted in identifying the key elements of the research project.

Ongoing analysis of customer or user feedback to improve the prototype design (feedback R&D of the copper sinkers).

Hunter Engineering’s eligible R&D activities during this phase of experimentation included:

- Ongoing analysis and testing to improve the efficiency and environmental safety of the project.

- Ongoing development and modification to interpret the experimental results and draw conclusions that served as starting points for the development of new hypotheses.

- Commercial analysis and functionality review.

These activities were considered “qualified research” because they were necessary to evaluate the performance capabilities of the new design in the field and to improve any flaws in the design.

Qualified research consists of research for the intent of developing new or improved business components. A business component is defined as any product, process, technique, invention, formula, or computer software that the taxpayer intends to hold for sale, lease, license, or actual use in the taxpayer’s trade or business.

The Four-Part Test

Activities that are eligible for the R&D Credit are described in the “Four-Part Test” which must be met for the activity to qualify as R&D.

- Permitted Purpose: The purpose of the activity or project must be to create new (or improve existing) functionality, performance, reliability, or quality of a business component.

- Elimination of Uncertainty: The taxpayer must intend to discover information that would eliminate uncertainty concerning the development or improvement of the business component. Uncertainty exists if the information available to the taxpayer does not establish the capability of development or improvement, method of development or improvement, or the appropriateness of the business component’s design.

- Process of Experimentation: The taxpayer must undergo a systematic process designed to evaluate one or more alternatives to achieve a result where the capability or the method of achieving that result, or the appropriate design of that result, is uncertain at the beginning of the taxpayer’s research activities.

- Technological in Nature: The process of experimentation used to discover information must fundamentally rely on principles of hard science such as physical or biological sciences, chemistry, engineering or computer science.

What records and specific documentation did Hunter Engineering keep?

Similar to all tax credits and deductions, Hunter Engineering had to save business records that outlined what it did in its R&D activities, including experimental activities and documents to prove that the work took place in a systematic manner.

Unfortunately, the only documentation that Hunter Engineering saved were design documents in the form of drawings, leaving vast room for improvement in the area of substantiation.

As a company claiming R&D, you always want to be “compliance ready” — meaning if you were audited by the IRS, you could present documentation to show the progression of your R&D work. Here are some types of documentation that would be beneficial to save:

- Project records/ lab notes

- Photographs/ videos of various stages of build/ assembly/ testing

- Prototypes

- Testing protocols

- Results or records of analysis from testing/ trial runs

- Tax invoices

- Patent application number

- Literature reviews

A Concord company designs and manufactures high-tech components for the electronics industry. The company claims R&D credits each year for the development activities of its engineers. This project involved a multi-year study.

The Company qualified for the federal R&D Tax Credits of $299,855 and an additional $60,000 in New Hampshire state R&D Tax Credits.

| FEDERAL | NEW HAMPSHIRE | |||||

| Year | Total QREs | Credit | Total QREs | Credit | ||

| Year 3 | $1.400.000,00 | $147.000,00 | $1.200.000,00 | $60.000,00 | ||

| Year 2 | $950.000,00 | $102.980,00 | N/A | N/A | ||

| Year 1 | $475.000,00 | $49.875,00 | N/A | N/A | ||

| Total | $2.825.000,00 | $299.855,00 | $1.200.000,00 | $60.000,00 | ||

Choose your state

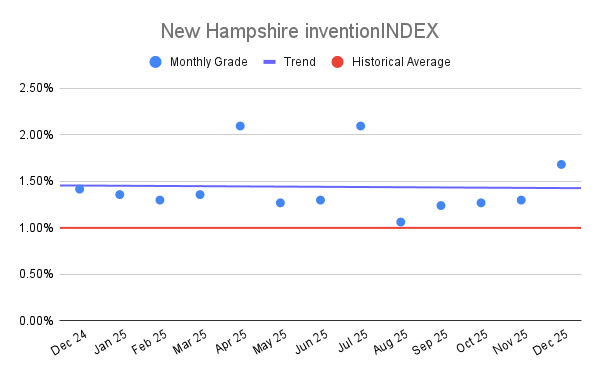

New Hampshire inventionINDEX Decem

New Hampshire inventionINDEX Decem  New Hampshire inventionIN

New Hampshire inventionIN