Utah R&D Tax Credit Filing Instructions

To claim the Research and Development (R&D) tax credit in Utah, businesses must engage in qualified research activities within the state, which largely align with the federal Section 41 definition of qualified research expenses (QREs). 1 While there isn’t a specific, standalone form solely for the R&D tax credit, the final credit amount is reported on Utah Form TC-40A, Income Tax Supplemental Schedule, Part 4, using code 12. 2 Businesses will need to calculate their credit based on either 5% of incremental QREs exceeding a base amount, 5% of certain incremental payments to qualified organizations for basic research, or 7.5% of total current-year QREs (though the 7.5% credit is not carried forward). It’s crucial to maintain thorough documentation supporting all qualified research activities and expenses, as these records will be necessary to substantiate the claim and in case of an audit. The R&D tax credit is non-refundable but can be carried forward for up to 14 years for the 5% incremental credits. The claim should be submitted with the business’s annual Utah state tax return.

Utah Patent of the Year – 2024/2025

Epitel Inc. has been awarded the 2024/2025 Patent of the Year for revolutionizing brain health monitoring. Their invention, detailed in U.S. Patent No. 11857330, titled ‘Systems and methods for electroencephalogram monitoring’, introduces a compact, wireless EEG system that enhances patient comfort and diagnostic accuracy.

Epitel’s innovative approach addresses the limitations of traditional EEG systems by utilizing small, disposable sensors that adhere securely to the scalp. These sensors wirelessly transmit brain activity data to mobile devices, enabling real-time monitoring without the constraints of bulky equipment or wires. This advancement is particularly beneficial for patients requiring continuous observation, such as those with epilepsy, as it allows for extended monitoring periods in various settings, including hospitals and at home.

The system’s design emphasizes ease of use, with intuitive setup processes and seamless integration with existing medical platforms. This ensures that healthcare providers can quickly adopt the technology without extensive training. Moreover, the wireless nature of the system reduces the risk of infection and enhances patient mobility during monitoring.

Epitel’s patented technology marks a significant step forward in neurodiagnostics, offering a more accessible and efficient means of monitoring brain activity. As the healthcare industry continues to embrace digital health solutions, innovations like Epitel’s wireless EEG system are paving the way for more personalized and timely patient care.

Study Case

Timmy’s Candies, Inc., founded in Georgia in the 1980’s, is a leading U.S. candy manufacturer specializing in the creation of American handmade sweets.

Since Timmy’s Candies inception, the business has matured with research and development (R&D) underlining the core of the company’s activities. In particular, it has developed a customized software system that improves its business by making it more efficient and cost effective.

Timmy’s Candies incurred qualified research expenses relating to the development of of its software in 2013. In order to qualify for the Research and Development Tax Credit, Timmy’s Candies needed to determine the eligibility of its proposed R&D activities. The “qualified research” must meet four main criteria, known as the Four-Part Test. Timmy’s Candies’ qualified research activities included the following.

The main objective of this R&D project was to create an innovative software system that would support product development and lean manufacturing. Timmy’s Candies developed a system that holds its product components in modular steps so its staff can choose each ingredient, shape and design to create a finished product on a virtual platform without using any real ingredients or equipment.

This system allowed Timmy’s Candies to discover if a product was going to fail beforehand, therefore significantly increasing work efficiency and reducing waste and costs. Specific technical objectives of this project are listed below.

Design and development of a series of prototypes to achieve the technical objectives (design and development of customized software system).

Timmy’s Candies’ hypothesis for this activity questioned whether a software system could be designed and developed to assist in improving the efficiency of their day to day business activities.

The experimental activities conducted in the design phase predominantly entailed computer modeling, conceptual drawings and mathematical calculations. These experiments could only be proven effective or ineffective in the prototype development and testing phase. Following the experiments in that phase, during which the software system was built and tested in various applications, the design was modified and re-tested until the desired outcome was achieved.

Trials and analysis of data to achieve results that can be reproduced to a satisfactory standard (development and testing of software).

The hypothesis for this activity stated that the ability to create its products in a virtual environment first before trialing and manufacturing them at the plant would significantly increase work efficiency while decreasing waste, labor time and costs.

Details of this experiment included development of virtual product components based on information gained through the model and testing of the virtual components to ensure efficiency and accuracy.

Background research to evaluate current knowledge gaps and determine feasibility (background research necessary for the development of customized software).

Prior to 2013, there was no system that allowed Timmy’s Candies to create its products in a virtual environment. Thus, besides the lack of comparable solutions available, the outcomes of activities in this research could not have been known or determined in advance due to a number of specific technical challenges.

Timmy’s Candies’ eligible R&D activities during this phase included:

Literature search and review, including maintaining up-to-date knowledge on relevant food safety standards and requirements.

Preliminary equipment and resources review with respect to capacity, performance and suitability for the project.

The background research conducted by Timmy’s Candies was directly related to the main objective of designing the customized software, therefore qualifying as R&D.

Ongoing analysis of user feedback to improve the prototype design (feedback R&D of the customized software).

Timmy’s Candies’ eligible R&D activities for this phase of its project included:

Ongoing analysis and testing to improve the efficiency and accuracy of the software.

Ongoing development and modification to interpret the experimental results and draw conclusions that served as starting points for the development of new hypotheses.

Commercial analysis and functionality review.

These activities were necessary to evaluate the performance capabilities of the new system and to improve any flaws in the design, therefore qualifying as R&D.

Qualified research consists of research for the intent of developing new or improved business components. A business component is defined as any product, process, technique, invention, formula, or computer software that the taxpayer intends to hold for sale, lease, license, or actual use in the taxpayer’s trade or business.

The Four-Part Test

Activities that are eligible for the R&D Credit are described in the “Four-Part Test” which must be met for the activity to qualify as R&D.

- Permitted Purpose: The purpose of the activity or project must be to create new (or improve existing) functionality, performance, reliability, or quality of a business component.

- Elimination of Uncertainty: The taxpayer must intend to discover information that would eliminate uncertainty concerning the development or improvement of the business component. Uncertainty exists if the information available to the taxpayer does not establish the capability of development or improvement, method of development or improvement, or the appropriateness of the business component’s design.

- Process of Experimentation: The taxpayer must undergo a systematic process designed to evaluate one or more alternatives to achieve a result where the capability or the method of achieving that result, or the appropriate design of that result, is uncertain at the beginning of the taxpayer’s research activities.

- Technological in Nature: The process of experimentation used to discover information must fundamentally rely on principles of hard science such as physical or biological sciences, chemistry, engineering or computer science.

What records and specific documentation did Wino keep?

Similar to any tax credit or deduction, Wino had to save business records that outlined what it did in its R&D activities, including experimental activities and documents to prove that the work took place in a systematic manner.

Wino saved the following documentation:

- Progress of project (e.g. meeting notes, minutes, emails, reports)

- Conceptual sketches and technical drawings

- Photographs of completed models

- Testing protocols

- Results or records of analysis from testing / trial runs

- Tax invoices

By having these records on file, Wino confirmed that it was “compliance ready” — meaning if it was audited by the IRS, it could present documentation to show the progression of its R&D work, ultimately proving its R&D eligibility.

A Utah-based sporting goods manufacturer employs close to one hundred employees in its Salt Lake City offices. The Company has been claiming the research and development tax credit for many years for activities around the development and improvement of their sporting goods and protective wear. This project involved a multi-year study.

The Company qualified for the federal R&D Tax Credits of $352,500 and an additional $352,500 in State R&D Tax Credits.

| FEDERAL | UTAH | |||||

| Year | Total QREs | Credit | Total QREs | Credit | ||

| 2026 | $1.200.000,00 | $120.000,00 | $1.200.000,00 | $120.000,00 | ||

| 2025 | $900.000,00 | $90.000,00 | $900.000,00 | $90.000,00 | ||

| 2024 | $775.000,00 | $77.500,00 | $775.000,00 | $77.500,00 | ||

| 2023 | $650.000,00 | $65.000,00 | $650.000,00 | $65.000,00 | ||

| Total | $3.525.000,00 | $352.500,00 | $3.525.000,00 | $352.500,00 | ||

Choose your state

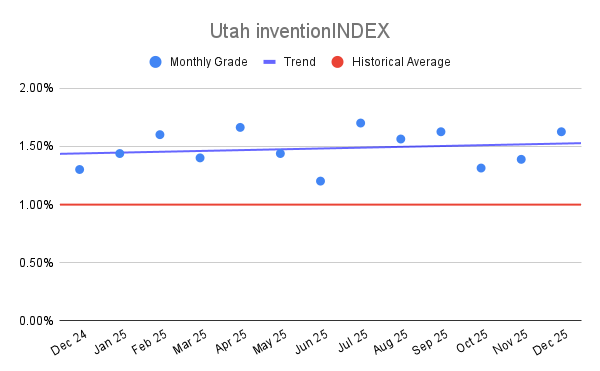

Utah inventionINDEX December 2025:

Utah inventionINDEX December 2025: Utah inventionINDEX November 2025:

Utah inventionINDEX November 2025: