Vermont Patent of the Month – January 2024

When it comes to turbomachinery, Concepts NREC LLC is the only company in the world with expertise and in-house capabilities that span the entire process – from conceptual design through manufacturing, testing, and installation. With expertise like this, it is no surprise to see the company has been granted a patent for their decoupled collector technology.

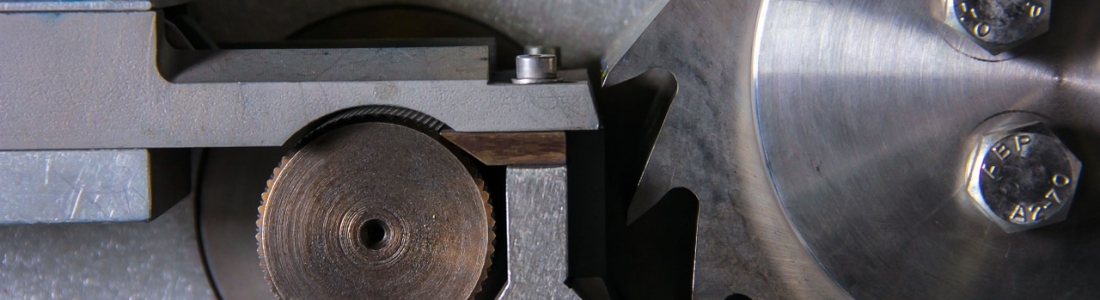

A compressor turbomachine is designed to impart energy to a working fluid with a rotating impeller. The higher energy fluid typically flows from the impeller into a collector. The working fluid is then typically directed to a pipe or duct via the outlet flange of the vessel.

At the heart of this new design is an intricate impeller, boasting a hub with a plurality of blades and shafts extending from opposing sides. This impeller, securely cradled within a robust frame, is a testament to precision engineering. What sets this invention apart is the ingenious integration of a collector—fluidly connected to the impeller—to efficiently gather and manage the discharged air.

In a departure from conventional designs, Concepts NREC introduces a distinctive feature—a pair of shrouds flanking the impeller blades. These shrouds, coupled to the frame, possess the remarkable ability to move in a first direction, allowing for precise control over the volume of air transferred from the impeller to the collector. This dynamic adjustment capability opens new avenues for optimizing performance in various operational scenarios.

Crucially, the collector is a standalone entity, mechanically decoupled from the impeller. This novel approach minimizes the transfer of both mechanical and thermal energy between the collector and the impeller. The frame plays a pivotal role in supporting the collector independently, laying the foundation for enhanced operational efficiency and longevity.

Concepts NREC introduces an element of resilience into the design by incorporating vibration-damping resilient material between the collector and the frame. This strategic integration ensures stability and durability, addressing potential challenges associated with mechanical vibrations.

The asymmetric shape of the collector, with a rotational axis offset from its centerline, further underscores the inventive nature of this turbomachine. This deliberate design choice optimizes the working fluid flow, directing it in a controlled manner for superior performance.

Are you developing new technology for an existing application? Did you know your development work could be eligible for the R&D Tax Credit and you can receive up to 14% back on your expenses? Even if your development isn’t successful your work may still qualify for R&D credits (i.e. you don’t need to have a patent to qualify). To find out more, please contact a Swanson Reed R&D Specialist today or check out our free online eligibility test.

Who We Are:

Swanson Reed is one of the U.S.’ largest Specialist R&D tax advisory firms. We manage all facets of the R&D tax credit program, from claim preparation and audit compliance to claim disputes.

Swanson Reed regularly hosts free webinars and provides free IRS CE and CPE credits for CPAs. For more information please visit us at www.swansonreed.com/webinars or contact your usual Swanson Reed representative.

What is the R&D Tax Credit?

The Research & Experimentation Tax Credit (or R&D Tax Credit), is a general business tax credit under Internal Revenue Code section 41 for companies that incur research and development (R&D) costs in the United States. The credits are a tax incentive for performing qualified research in the United States, resulting in a credit to a tax return. For the first three years of R&D claims, 6% of the total qualified research expenses (QRE) form the gross credit. In the 4th year of claims and beyond, a base amount is calculated, and an adjusted expense line is multiplied times 14%. Click here to learn more.

R&D Tax Credit Preparation Services

Swanson Reed is one of the only companies in the United States to exclusively focus on R&D tax credit preparation. Swanson Reed provides state and federal R&D tax credit preparation and audit services to all 50 states.

If you have any questions or need further assistance, please call or email our CEO, Damian Smyth on (800) 986-4725.

Feel free to book a quick teleconference with one of our national R&D tax credit specialists at a time that is convenient for you.

R&D Tax Credit Audit Advisory Services

creditARMOR is a sophisticated R&D tax credit insurance and AI-driven risk management platform. It mitigates audit exposure by covering defense expenses, including CPA, tax attorney, and specialist consultant fees—delivering robust, compliant support for R&D credit claims. Click here for more information about R&D tax credit management and implementation.

Our Fees

Swanson Reed offers R&D tax credit preparation and audit services at our hourly rates of between $195 – $395 per hour. We are also able offer fixed fees and success fees in special circumstances. Learn more at https://www.swansonreed.com/about-us/research-tax-credit-consulting/our-fees/

Choose your state