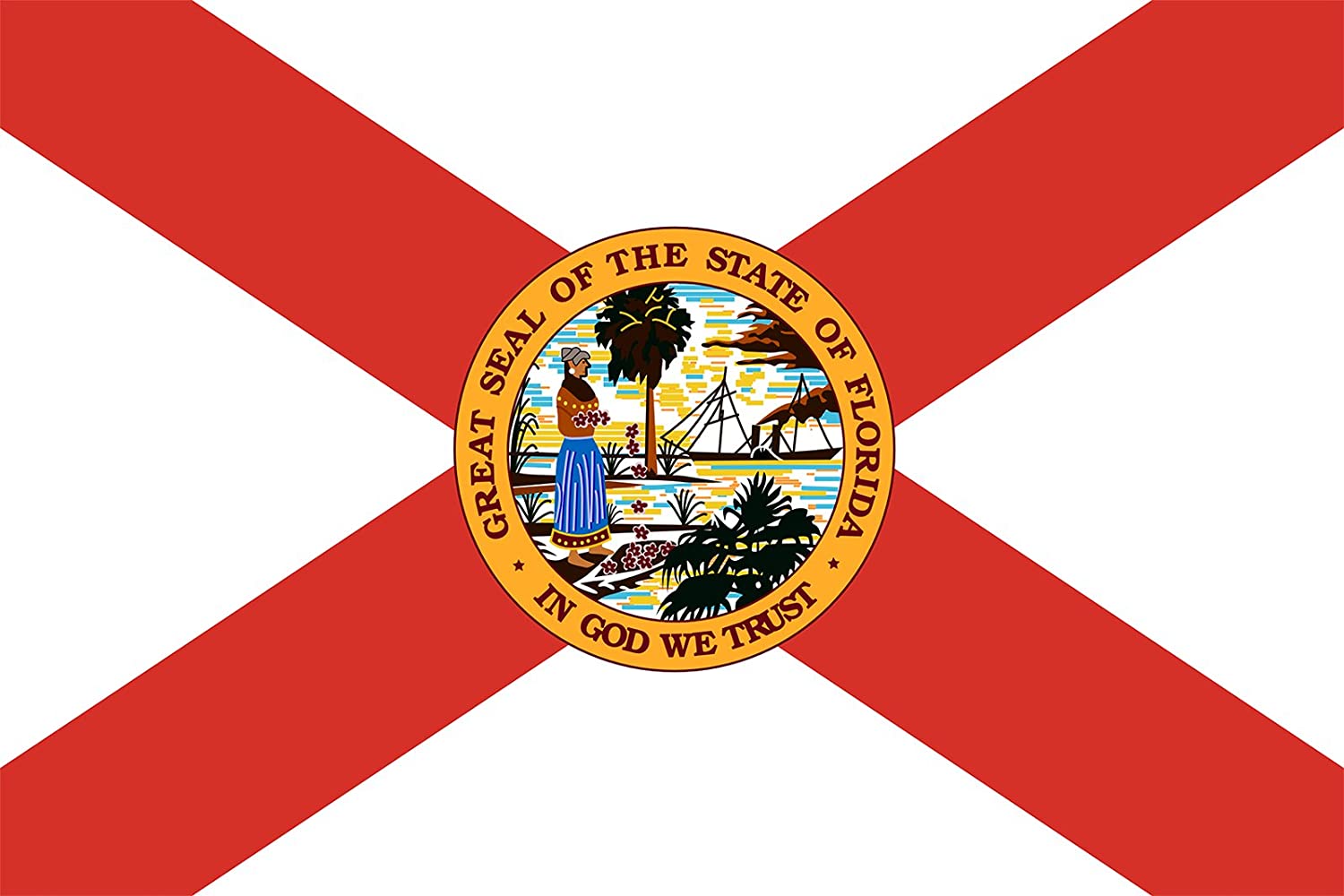

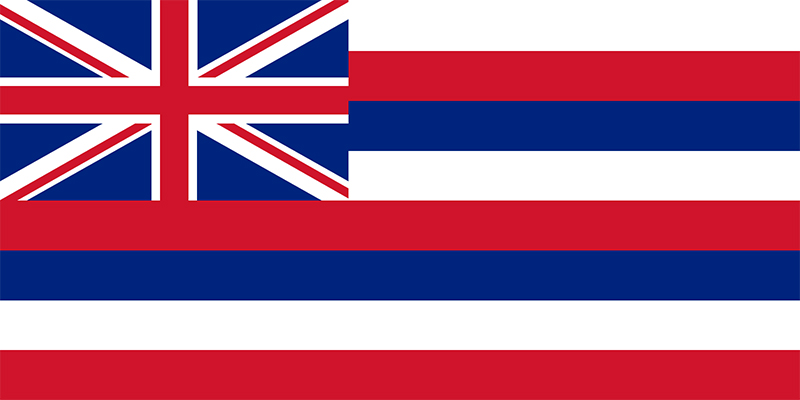

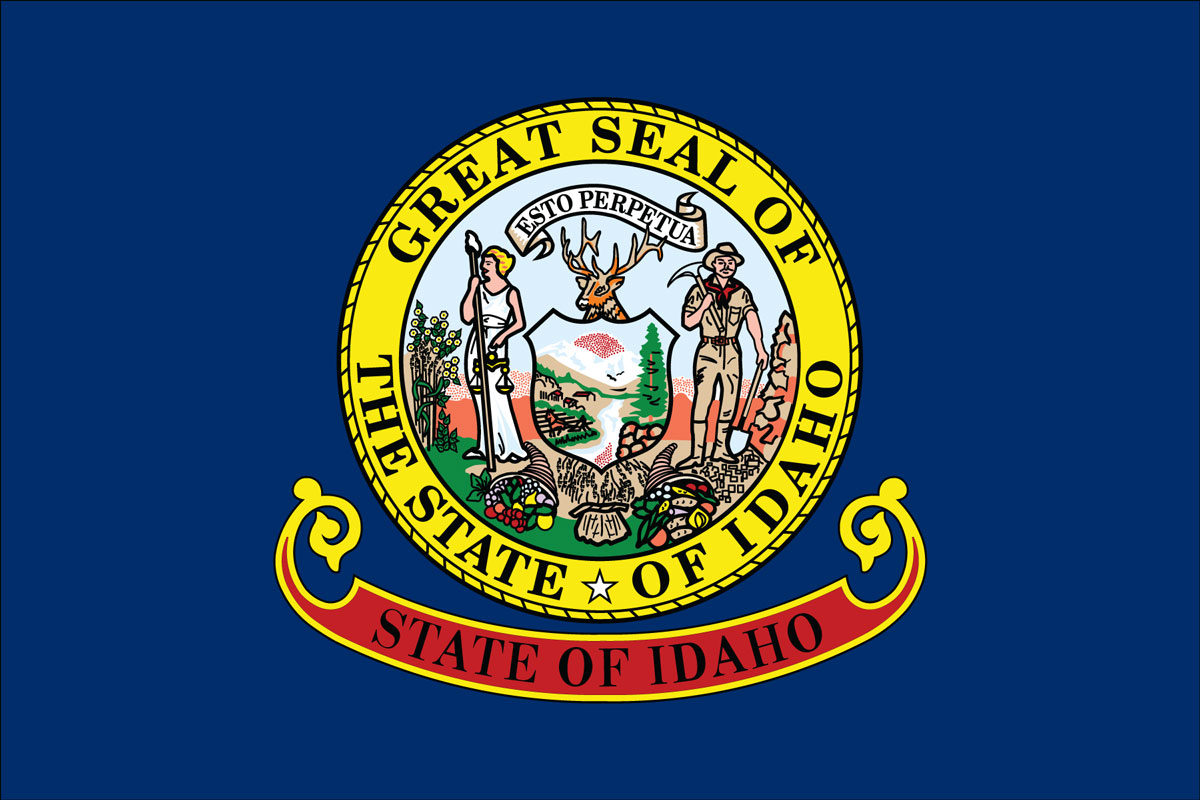

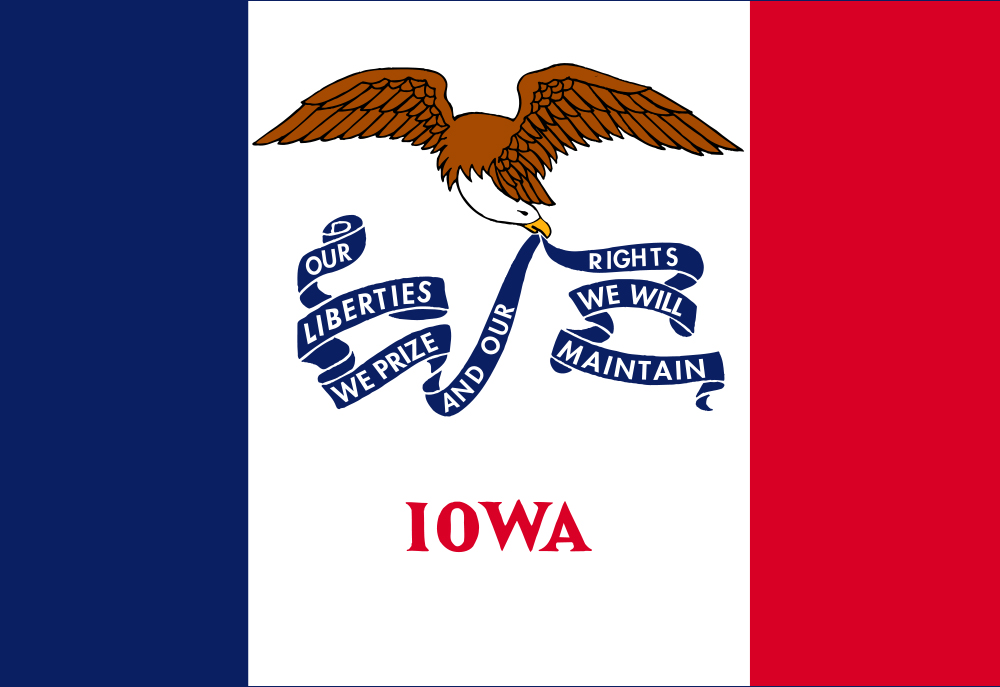

Program Overview: What is Swanson Reed’s Patent of the Month?

Swanson Reed’s Patent of the Month is a monthly recognition program that identifies and highlights the most transformative patent applications filed in each U.S state.

Key Selection Criteria

The AI system evaluates candidates using a weighted scoring metric across three primary dimensions to ensure Entity Density and relevance:

| Metric | Definition |

|---|---|

| Technological Radicalness | Discerns fundamental new principles of operation versus minor hardware modifications. |

| Market Scope | Analyzes Total Addressable Market (TAM), prioritizing broad industrial applicability over niche usage. |

| Economic Utility | Weighs tangible financial benefits, such as cost reduction mechanisms and yield enhancement. |

Winners are chosen through using AI to scan thousands of patent applications per month and ranking inventions based on novelty and practical use. Winning this distinction is highly competitive due to the sheer volume of high-quality patent applications submitted by leading companies, startups, and research institutions. Only the most groundbreaking inventions—those demonstrating exceptional novelty, technical advancement, and potential market influence—are selected. With advancements in fields like AI, biotechnology, and clean energy accelerating, the bar for Patent of the Month is set extraordinarily high. Companies fiercely compete for this honor, as it not only validates their R&D efforts but also enhances their reputation among investors and industry peers. The intense competition reflects the rapid pace of innovation and the growing importance of intellectual property in today’s technology-driven economy.

Patent of the Month selection is driven by a sophisticated AI system designed to sift through vast amounts of intellectual property data to identify true innovation. Rather than relying solely on manual review, this proprietary metric applies a weighted scoring system to analyze over 1,000 patents filed or granted in the region. The AI acts as a high-impact filter, processing this large volume of data to isolate specific signals that distinguish a transformative invention from a standard filing.

To determine a patent’s score, the AI evaluates candidates against three critical dimensions:

-

Technological Radicalness: The system discerns whether a patent introduces a fundamental new principle of operation—such as laser ablation—or merely offers a minor modification to existing hardware, like a new chemical nozzle.

-

Market Scope: The AI analyzes the Total Addressable Market (TAM), prioritizing technologies applicable to a broad industrial base over those limited to niche markets.

-

Economic Utility: The scoring weighs the potential for tangible financial benefits, specifically looking for mechanisms that drive cost reduction (such as reduced chemical usage) and yield enhancement.

Ultimately, the our AI system seeks to pinpoint technologies that sit at the intersection of major high-growth sectors. By combining these weighted metrics, the AI ensures that the selected patent represents not just a technical novelty, but a commercially viable leap forward with the potential to reshape industry standards.