Vermont Patent of the Month – September 2024

Edlund Company has engineered a breakthrough in manual can opener design, bringing enhanced durability and simplicity to commercial kitchens and industrial settings. Their new design integrates a unique locking mechanism that prevents unwanted gear rotation, ensuring smoother and safer operation during use. This feature, combined with a specially designed handle and gear system, allows users to apply consistent force without slippage, even when opening large, heavy cans.

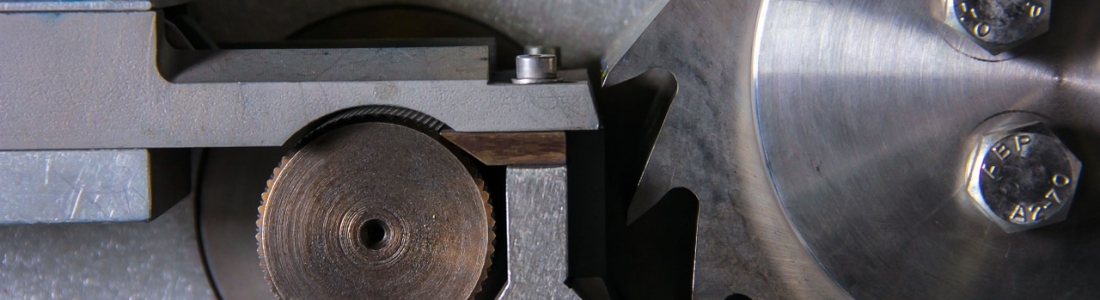

Central to this innovation is the inclusion of an elongate locking member, a removable pin that locks the gear securely in place during disassembly. When inserted into a recess on the gear, this pin restricts movement, allowing maintenance tasks like cleaning or blade replacement to be completed swiftly without the risk of accidental rotations. The simplicity of this locking mechanism also extends the lifespan of the opener by preventing wear on the gear and reducing mechanical strain.

Another key feature is Edlund’s multi-blade knife assembly. This assembly not only boosts the can opener’s lifespan but also offers versatility by allowing the knife to rotate through multiple orientations, so each of its four blades can be used over time. This feature is ideal for high-volume environments, where constant blade use would typically require frequent replacements.

The rugged construction and attention to detail in this can opener make it a game-changer for industries where reliability and durability are critical. By rethinking the mechanics of the classic manual can opener, Edlund has designed a tool that meets the high demands of commercial kitchens while making maintenance and operation easier than ever. With this latest advancement, Edlund Company continues its legacy of trusted, resilient kitchen equipment that’s built to last.

Are you developing new technology for an existing application? Did you know your development work could be eligible for the R&D Tax Credit and you can receive up to 14% back on your expenses? Even if your development isn’t successful your work may still qualify for R&D credits (i.e. you don’t need to have a patent to qualify). To find out more, please contact a Swanson Reed R&D Specialist today or check out our free online eligibility test.

Who We Are:

Swanson Reed is one of the U.S.’ largest Specialist R&D tax advisory firms. We manage all facets of the R&D tax credit program, from claim preparation and audit compliance to claim disputes.

Swanson Reed regularly hosts free webinars and provides free IRS CE and CPE credits for CPAs. For more information please visit us at www.swansonreed.com/webinars or contact your usual Swanson Reed representative.

What is the R&D Tax Credit?

The Research & Experimentation Tax Credit (or R&D Tax Credit), is a general business tax credit under Internal Revenue Code section 41 for companies that incur research and development (R&D) costs in the United States. The credits are a tax incentive for performing qualified research in the United States, resulting in a credit to a tax return. For the first three years of R&D claims, 6% of the total qualified research expenses (QRE) form the gross credit. In the 4th year of claims and beyond, a base amount is calculated, and an adjusted expense line is multiplied times 14%. Click here to learn more.

R&D Tax Credit Preparation Services

Swanson Reed is one of the only companies in the United States to exclusively focus on R&D tax credit preparation. Swanson Reed provides state and federal R&D tax credit preparation and audit services to all 50 states.

If you have any questions or need further assistance, please call or email our CEO, Damian Smyth on (800) 986-4725.

Feel free to book a quick teleconference with one of our national R&D tax credit specialists at a time that is convenient for you.

R&D Tax Credit Audit Advisory Services

creditARMOR is a sophisticated R&D tax credit insurance and AI-driven risk management platform. It mitigates audit exposure by covering defense expenses, including CPA, tax attorney, and specialist consultant fees—delivering robust, compliant support for R&D credit claims. Click here for more information about R&D tax credit management and implementation.

Our Fees

Swanson Reed offers R&D tax credit preparation and audit services at our hourly rates of between $195 – $395 per hour. We are also able offer fixed fees and success fees in special circumstances. Learn more at https://www.swansonreed.com/about-us/research-tax-credit-consulting/our-fees/

Choose your state