Arizona Patent of the Month – September 2023

TYR Tactical, LLC has operated under a unique motto: INNOVATE OR DIE®. This motto has helped the company to push the standards of today’s tactical equipment and is the primary reason for their newly granted patent.

This design encompasses flexible body armor with a ballistic vest, body armor components, and an exterior framework to create a comprehensive solution for personal protection.

The heart of this innovation lies in its ability to dissipate the force generated by the impact of a ballistic projectile. Traditional ballistic vests rely solely on layers of body armor to absorb and distribute the force, which can lead to issues like back face deformation and limited flexibility.

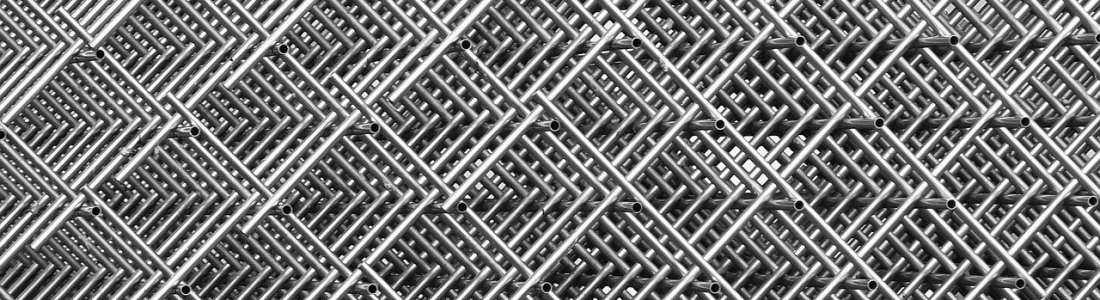

TYR Tactical’s ballistic vest system takes a different approach. It incorporates an exterior framework that provides structural integrity to the body armor component. This framework not only prevents sagging but also plays a crucial role in enhancing the vest’s protective capabilities.

What sets this framework apart is the material used in its construction. It’s crafted from advanced materials such as polyethylene, ABS plastic, or aramid fiber, all of which are known for their excellent energy-absorbing properties. This means that when a ballistic projectile impacts the vest, the force is not only absorbed by the body armor but also further dissipated by the framework itself.

The framework is designed to match the shape of the body armor component, ensuring a perfect fit. It’s positioned behind and adjacent to the body armor, seamlessly integrated into the ballistic vest. This integration not only enhances protection but also maintains the wearer’s mobility and comfort.

In addition to its structural advantages, TYR Tactical’s ballistic vest system is made from a composite fabric material that combines high-performance nylon with high tenacity polymer fibers. This combination results in a vest that’s not only highly protective but also lightweight and durable.

The framework further improves the vest’s performance by featuring strategically placed openings that aid in ventilation. This helps to regulate the wearer’s body temperature during extended use, preventing discomfort and fatigue.

Are you developing new technology for an existing application? Did you know your development work could be eligible for the R&D Tax Credit and you can receive up to 14% back on your expenses? Even if your development isn’t successful your work may still qualify for R&D credits (i.e. you don’t need to have a patent to qualify). To find out more, please contact a Swanson Reed R&D Specialist today or check out our free online eligibility test.

Who We Are:

Swanson Reed is one of the U.S.’ largest Specialist R&D tax advisory firms. We manage all facets of the R&D tax credit program, from claim preparation and audit compliance to claim disputes.

Swanson Reed regularly hosts free webinars and provides free IRS CE and CPE credits for CPAs. For more information please visit us at www.swansonreed.com/webinars or contact your usual Swanson Reed representative.

What is the R&D Tax Credit?

The Research & Experimentation Tax Credit (or R&D Tax Credit), is a general business tax credit under Internal Revenue Code section 41 for companies that incur research and development (R&D) costs in the United States. The credits are a tax incentive for performing qualified research in the United States, resulting in a credit to a tax return. For the first three years of R&D claims, 6% of the total qualified research expenses (QRE) form the gross credit. In the 4th year of claims and beyond, a base amount is calculated, and an adjusted expense line is multiplied times 14%. Click here to learn more.

R&D Tax Credit Preparation Services

Swanson Reed is one of the only companies in the United States to exclusively focus on R&D tax credit preparation. Swanson Reed provides state and federal R&D tax credit preparation and audit services to all 50 states.

If you have any questions or need further assistance, please call or email our CEO, Damian Smyth on (800) 986-4725.

Feel free to book a quick teleconference with one of our national R&D tax credit specialists at a time that is convenient for you.

R&D Tax Credit Audit Advisory Services

creditARMOR is a sophisticated R&D tax credit insurance and AI-driven risk management platform. It mitigates audit exposure by covering defense expenses, including CPA, tax attorney, and specialist consultant fees—delivering robust, compliant support for R&D credit claims. Click here for more information about R&D tax credit management and implementation.

Our Fees

Swanson Reed offers R&D tax credit preparation and audit services at our hourly rates of between $195 – $395 per hour. We are also able offer fixed fees and success fees in special circumstances. Learn more at https://www.swansonreed.com/about-us/research-tax-credit-consulting/our-fees/

Choose your state